The Bottom Line: Magnificent Seven stocks made significant but varying contributions to the 2024 performance of the top ten large cap growth and blended funds.

Notes of explanation: Top 10 performing funds include: Xtrackers S&P 500 Growth ESG ETF*, Praxis Growth Index A*, iShares ESG Aware MSCI USA Growth ETF*, Nuveen Winslow Large-Cap Growth ESG R6, Neuberger Berman Sustainable Equity E, TCW Transform Systems ETF*, Calvert US Large Cap Growth Responsible Index R6*, Parnassus Growth Equity Institutional, Transamerica Sustainable Growth Equity A and American Century Large Cap Growth ETF. *Refers to index fund. Sources: Sustainable Research and Analysis LLC., fund reports.

Observations:

• Except for the performance of one small thematic fund, the next ten best performing funds in 2024, a combination of six mutual funds and four ETFs, consist of large growth and blended funds that produced an average return of 29.6% across a range from 26.68% to 34.05%*. This is across a universe of 1,383 focused sustainable long-term mutual funds/share classes and ETFs that reached $353.3 billion at the end of 2024. On a combined basis, including all fund types, this universe of focused sustainable long-term funds registered an average gain in 2024 of 8.60%. These results compare to a 2024 gain of 25.02% recorded by the S&P 500 Index, 24.02% reached by the S&P 500 ESG Index, and a 36.07% increase for the S&P 500 Growth Index.

• Posting average gains of 63% over 2024 and accounting for more than half of the increase achieved by the S&P 500 were seven stocks referred to as the Magnificent Seven. These include Alphabet, Inc (Google, Class A and Class C), Amazon.com Inc., Apple Inc., Meta Platforms, Inc. (Facebook), Microsoft Corp., Nvidia Corp. and Tesla Inc.

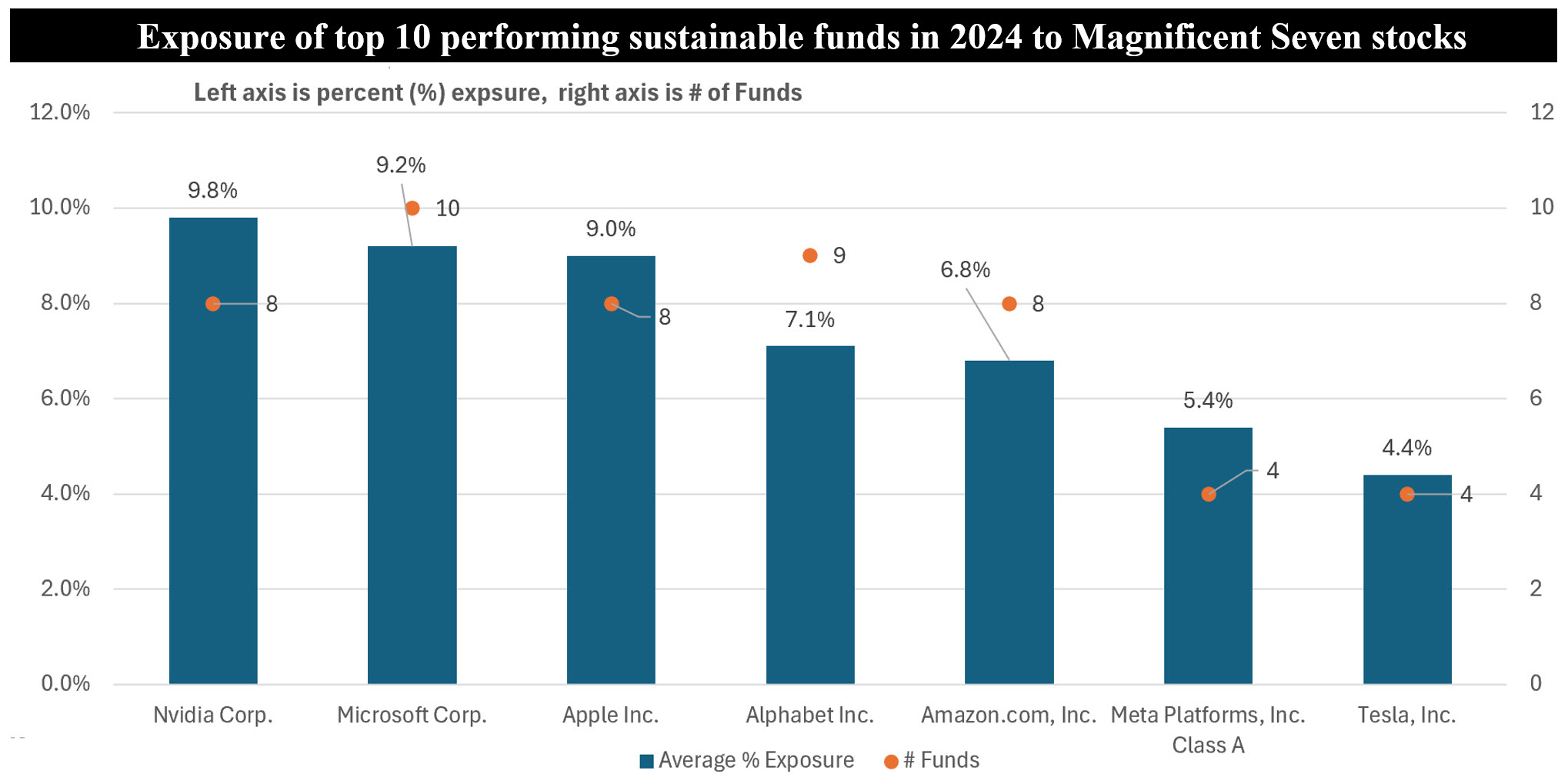

• The same Magnificent Seven made significant but varying contributions to the performance of the top ten large cap growth and blended funds, depending on levels of exposure. That said, all ten funds had some level of exposure to one or more Magnificent Seven stocks.

• Microsoft Corp. was the most widely held stock across the ten funds. Exposures on a percentage basis by each of the funds ranged from a low of 6.0% by the TCW Transform Systems ETF (NETZ) to a high of 12.1% held by the Nuveen Winslow Large-Cap Growth ESG Fund (NWCFX**). In decreasing order based on the number of fund holders, were Alphabet Inc. (9), Amazon.com, Inc. (8), Apple Inc. (8), Nvidia Corp. (8), Meta Platforms, Inc. (4) and Tesla (4). Based on ESG ratings assigned by MSCI that measure a company’s exposure to financially relevant ESG risks, NVIDIA and Microsoft, with MSCI’s top ratings of AA and AAA, respectively, are considered Leaders. At the same time, Meta Platforms, Inc., which is held by just four of the ten firms, received a low B and is considered a Laggard largely based on its corporate behavior. The other six companies are rated BBB and are considered Average.

• The best performing fund in 2024 is the small $3 million thematic Newday Ocean Health ETF (AHOY) that posted a gain of 88.12% in December that led to the equally spectacular 122.3% increase in 2024. A thematic exchange-traded fund launched in June 2022, advised by Tidal Investments and sub-advised by Newday Funds, Inc., the fund “actively invests in companies from around the world that make positive contributions to Ocean Health or those perceived to have concern and attentiveness to CO2 emissions, product waste, and discharge into bodies of water.” It benefited in 2024 from strong performance attributable to several 5% or so holdings in companies such as Cargotec Oyj, a Finnish-based company involved in sustainable cargo flow, Walmart, Inc. and Organo Corp. It should be noted that during its fiscal year ended May 2024, the fund made material revisions to its principal investment strategies.

*Calculated for mutual funds based on the best performing share class.

**Refers to the best performing R6 share class.