The Bottom Line: Sustainable investors and financial intermediaries should look beyond the limiting focused sustainable fixed income investment funds universe to identify eligible investment funds.

Notes of Explanation: Data as of year-end 2024, in $millions. Other refers to Allocation, Commodities and Miscellaneous (Trading-Leveraged Equity) fund categories. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.LC.

Observations:

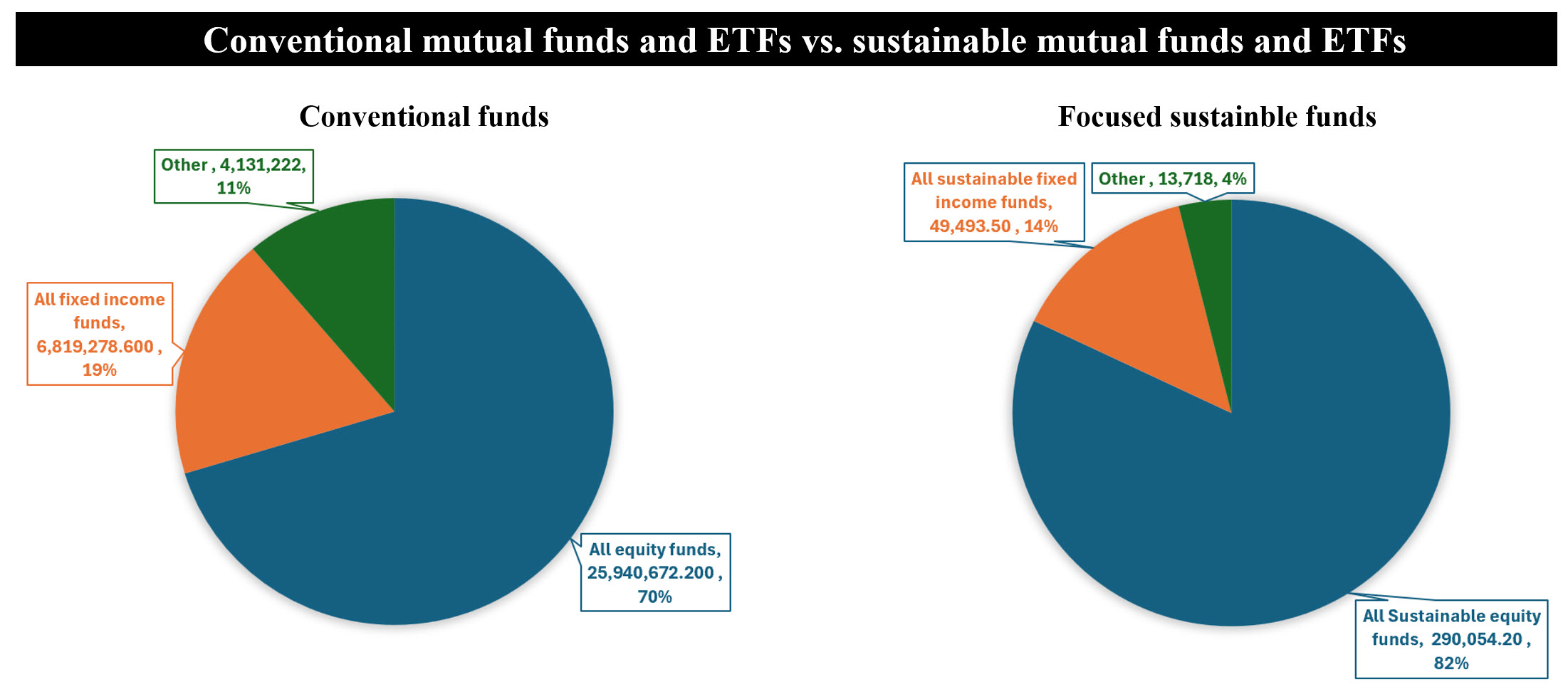

• Focused sustainable fixed income funds, as classified by Morningstar, ended 2024 at $49.5 billion in net assets, up from $46.7 billion the prior year. These funds, including taxable and municipal funds, now represent 14% of the focused long-term sustainable mutual funds and ETFs segment that ended the year with $353.3 billion in net assets. Focused sustainable fixed income funds also make up under 1% of total fixed income mutual funds and ETFs. By way of comparison, conventional fixed income funds controlled $6.8 trillion in assets (138X larger than focused sustainable fixed income funds) and accounted for 18% of conventional long-term funds under management at year-end 2024 which stood at $37.2 trillion.

• Beyond their relative sizes, the two segments, as defined, reflect significant variations in the number of funds offered, fund sizes, the number and type of investment categories and the universe of fixed income fund vestment managers. At year-end 2024, there were a total of 293 sustainable fixed income funds/share classes, with an average size of $168.9 million, that are classified into 18 investment categories offered by 51 or so investment management firms. On the other hand, there were 6,565 conventional fixed income funds/share classes with an average size of $1,038.8 million that are classified into 41 different investment categories and managed by some 320 investment advisory firms. In turn, these variations have an impact on fund expense ratios and overall performance results.

• The limited offerings in the focused sustainable fixed income funds segment makes it challenging for dedicated sustainable investors to achieve optimal risk mitigation when it comes to modeling the fixed income-oriented asset allocation component of their investment strategy aimed at achieving diversification across different kinds of assets. For example, at the present time, the segment doesn’t offer inflation protected bond funds and very few, if any, emerging market bond funds (outside local currency bond funds) that limit exposure to foreign currency risks.

• That said, investors who embrace a widely accepted definition of sustainable investing can find additional options outside those identified by Morningstar’s classification framework. Such a widely accepted sustainable investing definition encompasses a range of approaches by which investors aim to achieve financial returns while promoting long-term environmental and/or social values. These include values-based approaches, screening and exclusions, impact and thematic-oriented investing and ESG integration or ESG scoring, one of the most dominant investment approaches. Any one of these can also include shareholder engagement as well as proxy voting.

• Just one example, involving the Inflation-Protected Bond category, is the $663.9 million JPMorgan Inflation Managed Bond ETF. The fund is not classified as a focused sustainable fixed income fund by Morningstar. According to its prospectus, the fund, as part of its investment process, seeks, to assess the impact of environmental, social and governance (ESG) factors on certain issuers or countries in the universe in which the fund may invest. The adviser’s assessment is based on an analysis of key opportunities and risks across industries to seek to identify financially material issues with respect to the fund’s investments in issuers and ascertain key issues that merit engagement with issuers. The fund carries the highest A rating by Sustainable Research and Analysis based on scoring a combination of five screens that include management company quality, years in operation, total return performance over one, three and five years, expense ratio as well as fund size.

*Prior to 2022, the was organized as a mutual fund managed by J.P. Morgan Investment Management Inc., the same advisor.