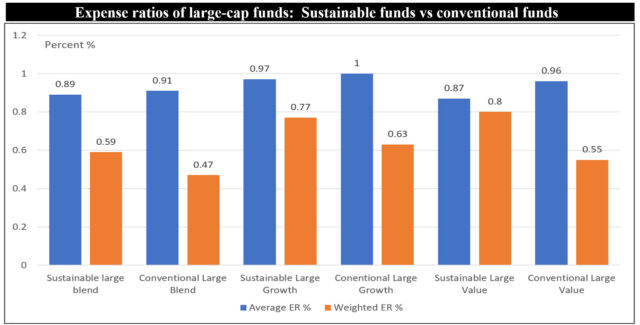

The Bottom Line: Mean expense ratios are lower, but average weighted expense ratios of sustainable, actively managed, large-cap funds are higher than conventional fund counterparts.

Notes of Explanation: Universe includes actively managed sustainable and conventional mutual funds and ETFs, based on Morningstar classifications. Basis points =1/100 of 1%. Data as of December 31, 2023. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Universe includes actively managed sustainable and conventional mutual funds and ETFs, based on Morningstar classifications. Basis points =1/100 of 1%. Data as of December 31, 2023. Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- An examination of expenses charges by sustainable actively managed large cap mutual funds and ETFs as of December 2023, in the form of expense ratios or internal fund operating charges paid by investors, shows that average expense ratios ranged from 87 basis points (bps) to 97 basis points. At the same time, average weighted expense ratios, that consider the size of funds, are significantly lower. These range from a low of 59 bps to a high of 80 bps. Sustainable actively managed large- cap funds, including growth funds, value funds and blended funds make up a large 47% of the assets under management linked to sustainable long-term actively managed funds.

- When compared to conventional actively managed large cap funds, the average expense ratios of sustainable funds are lower, but this relationship does not hold up when compared to average weighted expense ratios. Conventional funds benefit from their larger sizes and offer investors lower expense ratios ranging from 12 bps to 25 bps.

- This relationship also holds up for funds offered to large and institutional investors, defined as funds requiring minimum investments of $10,000 or more.

- A fund’s expense ratio is not the only factor to consider when evaluating an investment in a mutual fund or ETF, but it is an important consideration. Other important factors include the management company, historical performance track record and sustainable investing approach or strategy. A fund’s expense ratio directly affects the fund’s total return performance over time, and even a small difference in expense ratios can have a significant effect on net investment outcomes. For example, if two identical rates of return are earned by a fund, say 6%, but one fund charges 15 bps in fees and another charges 75 bps in fees, an investment of $10,000 over 30 years would yield upwards of $8,000 by the fund with the lower expense ratio.

- However, when combined with knowledge that actively managed large-cap funds rarely beat securities market indices, a compelling argument can be made for choosing to invest in a low-cost large cap sustainable passively managed mutual fund or ETF. According to S&P/Dow Jones Indices, only 39% of large-cap funds outperformed the S&P 500 Index over the one-year period ended June 30, 2023, and the percentage of large-cap funds outperforming over the three, five and 10-year intervals declined to 14%.