The Bottom Line: Of 75 sustainable fund categories covering all fund asset classes, only 30 categories, or 40%, posted average positive results in January 2024.

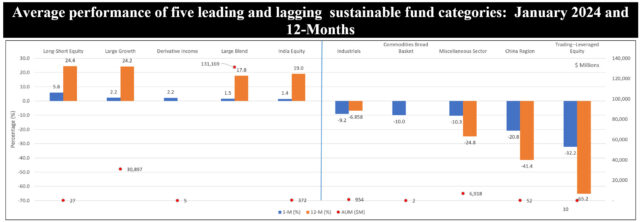

Notes of Explanation: Left side displays leading sustainable fund categories while right side displays lagging sustainable fund categories. Red dots indicate the fund category’s total size in terms of assets under management as of January 31, 2024. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Left side displays leading sustainable fund categories while right side displays lagging sustainable fund categories. Red dots indicate the fund category’s total size in terms of assets under management as of January 31, 2024. Sources: Morningstar Direct and Sustainable Research and Analysis LLC. Observations:

- The various asset classes that make up the sustainable mutual fund and ETF segment of short (money market funds) and long-term funds, which extends to 1,578 funds/share classes, according to Morningstar, and reached $335 billion in assets at the end of January, are comprised of 75 long-term fund categories.

- The universe of sustainable funds and ETFs posted an average decline of 0.77% in January, versus a gain of 1.7% for the S&P 500, a 0.99% decline for the MSCI ACW, ex USA Index, and a decline of 0.27% registered by the Bloomberg US Aggregate Bond Index.

- Of the 75 fund categories, only 30 categories, or 40%, posted average positive results in the first month of the year. In fact, 53% of sustainable funds turned in negative results in January versus only 1% of funds in December 2023–illustrating that short term results should generally be discounted.

- The top five performing categories included two of the largest sustainable fund categories, namely Large Growth and Large Blend funds, with a combined total of 253 funds/share classes and $162.1 billion in assets, or 48% of sustainable fund assets. These categories, which recorded average gains of 2.22% and 1.5%, respectively, continued to benefit from their higher exposures to the technology sector. The NASDAQ 100 Index posted a gain of 1.89% in January after achieving a 55.1% increase in 2023.

- The top five performing categories also tracked some of the smallest fund categories, including Long-Short Equity and Derivative Income, that posted average gains of 5.85% and 2.19%, respectively. Long-Short Equity currently tracks only one fund, the $27.1 million AQR Sustainable Long-Short Equity Aware Fund that invests long and short across global equity markets, integrating certain environmental, social, and governance considerations into its security selection and portfolio construction processes and seeking to hedge climate risks. The Derivative Income category is comprised of two small Global X ESG index tracking funds, fashioned around theoretical S&P 500 and NASDAQ 100 index portfolios with covered call writing.

- At the other end of the range, average total return declines in excess of 20% were posted by small single fund categories, including Trading-Leveraged Equity and China Region. Comprised of two leveraged Direxion ETFs focused on clean energy and electric and autonomous vehicles as well as KraneShares MSCI China Clean Tech funds, these funds recorded significant declines in January due to continued challenges in the renewable energy sector, lower than expected demand for electric vehicles as well as concerns regarding the economic outlook in China.