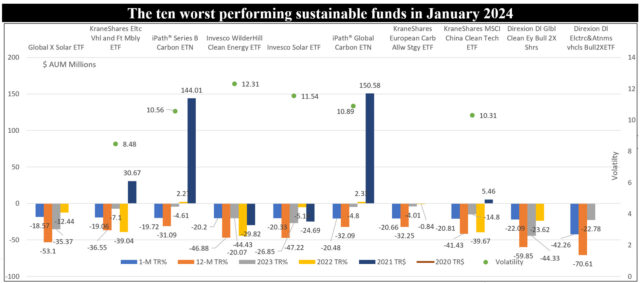

The Bottom Line: The worst ten performing funds in January, all thematic ETFs and ETNs focusing on renewable energy, posted an average decline of 22.4%.

Notes of Explanation: Universe of sustainable funds includes mutual funds and ETFs. Funds are listed in descending order of performance based on January 2024 results. Volatility, which is not available for all funds, is calculated based on monthly returns over the previous three years. Not Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Universe of sustainable funds includes mutual funds and ETFs. Funds are listed in descending order of performance based on January 2024 results. Volatility, which is not available for all funds, is calculated based on monthly returns over the previous three years. Not Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- The 10 worst performing sustainable investment funds in January posted an average decline of 22.4%, in dramatic contrast to the S&P 500 that gained 1.68% while sustainable US equity funds added 0.59%. Returns for the month ranged from a low of -42.3% to a high of -18.6%. The same funds recorded an average drop of 45.1% over the previous 12 months while the S&P 500 gained 20.8%.

- The ten funds are all equity-oriented or commodity focused thematic ETFs and Exchange Traded Notes (ETNs) that can be classified into three renewable energy themes, each of which continued to face challenges that contributed to their poor performance this month, last year and, in some cases, over the previous three years. In fact, 2020 was the last year during which the funds in this group that were in operation that year posted positive results across the board, and strong positive results at that.

- Six funds pursue renewable energy strategies, including one 2X leveraged fund, and one fund that is China focused. Three funds, including two ETNs, are linked to the dynamics of carbon credit pricing while two funds focus on the electric vehicle market and future mobility themes, including another 2X leveraged fund.

- Investment opportunities in clean and renewable energy have attracted at least $1.8 trillion in 2023 according to Bloomberg NEF and perhaps as much as $2.8 trillion, but clean energy stocks have faced headwinds and volatility due to high interest rates, supply chain disruptions, project delays, regulatory issues and repricing attributable to shifts in investor sentiments. Still, the global shift to renewable energy remains a positive trend. That said, investors taking positions in thematic clean energy funds, which are also exposed to concentrations risks on the fund level, have to brace for ongoing volatility which over the previous three years has been twice as high as an S&P 500 ESG portfolio, and be prepared for a commitment over an intermediate-term time horizon of at least three years.

- Funds investing in carbon allowances that are regulated by government organizations have been equally volatile and are not for the faint of heart. The dynamics of carbon pricing are complex, and carbon prices have experienced a significant decline. A contributing factor has been the ongoing scrutiny and reputational issues faced by the voluntary carbon market in 2023.**

![Performance-1-istockphoto-1037713088-612×612-1[1] Stock and financial exchange graph over a trading board screen. Selective focus. Horizontal composition with copy space. Low angle view.](https://sustainablest.wpengine.com/wp-content/uploads/elementor/thumbs/Performance-1-istockphoto-1037713088-612x612-11-r9s7e462qptb3hvrrdim72sizl0h5pf3lxjukbp48c.jpg)