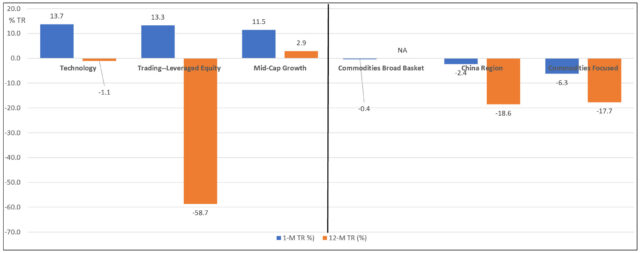

The Bottom Line: Across 76 investment categories as defined by Morningstar, sustainable Technology funds delivered the top total return in November 2023—an average of 13.7%.

Top and bottom three investment fund categories by November 2023 average total return results  Notes of Explanation: Top and bottom three investment fund categories arrayed based on November 2023 average performance results. Corresponding trailing 12-month returns are also shown. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Top and bottom three investment fund categories arrayed based on November 2023 average performance results. Corresponding trailing 12-month returns are also shown. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Top and bottom three investment fund categories arrayed based on November 2023 average performance results. Corresponding trailing 12-month returns are also shown. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Top and bottom three investment fund categories arrayed based on November 2023 average performance results. Corresponding trailing 12-month returns are also shown. Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- Positive sentiment pushed stock prices higher in the US and overseas in November while bond prices gained as yields declined sharply. Global stocks, as measured by the MSCI ACWI, ex USA Index, recorded their strongest monthly gain since November 2022, registering an increase of 9%. At the same time, US large cap stocks tracked by the S&P 500 added 9.13%, the best monthly result since July 2022 while the Nasdaq 100 Composite Total Return Index rose 10.8%. The Bloomberg US Aggregate Bond Index added 4.53%, pulling into positive territory on a year-to-date basis with a rise of 1.64%.

- Against this backdrop, sustainable mutual funds and ETFs, a total of 1,588 funds/share classes with $326.9 billion in net assets, posted an average gain of 7.6%. Equity funds added an average of 9.3% while fixed income funds registered an average gain of 4.1%. Across 76 investment categories defined by Morningstar, Technology funds delivered the top average return, followed by Trading-Leveraged Equity funds and Mid-Cap Growth funds, posting average returns of 13.7%, 13.3% and 11.5%, respectively. At the other end of the range, Commodities Focused, China Region and Commodities Broad Basket fund delivered the lowest average returns in November. With average returns ranging from -6.3%, -2.4%, and -0.4%, these were also the only categories to produce negative average returns in November.

- Comprised of just six thematic funds, nine funds/shares classes in total with $147 million in net assets, the results achieved by the best performing investment category features three funds with performance in November that placed them among the top ten performing funds for the month. These include Eventide Exponential Technologies A (ETAEX 15.34%), Xtrackers Semiconductor Select Equity ETF (CHPS 17.71%) and Xtrackers Cybersecurity Select Equity ETF (PSWD 14.69%). In addition to their thematic classification, each of these three funds also incorporate varying ESG exclusionary practices that serve to refine and reduce their universe of eligible securities. It should be noted that shares of CHPS and PSWD are not currently offered for purchase, according to company filings.

- There was a wide-ranging difference in the total return results achieved by individual funds in November. The top performing fund in November is the $76.5 million AXS Green Alpha ETF (NXTE). The fund, which was up 18.24%, is classified by Morningstar as a sustainable Global Large Blend Stock fund. That said, this is a thematic fund investing in sustainable companies, defined by Green Alpha Advisors, LLC, the fund’s sub-advisor, as companies that seek to mitigate global sustainability systemic risks. Such risks include, but are not limited to, the climate crisis, natural resource degradation and scarcity, and human disease burdens. The fund benefited from holdings in companies such as Taiwan Semiconductor Manufacturing Company, Applied Materials Inc, Lam Research Corp. there were up between 29% and 59% over the trailing twelve months. At the other end of the range is KraneShares Global Carbon Offset Strategy ETF (KSET) that registered a 23.6% decline in November and -90% over the previous 12 months.

- Exposure to technology funds in particular and thematic funds more generally have a place in diversified portfolios, but levels of exposure should be qualified by an investor’s financial goals and objectives, their financial profile and risk/reward tolerances.

![COW-12-18-2023-2iStock-913114646-scaled[1] COW-12-18-2023-2iStock-913114646-scaled[1]](https://sustainablest.wpengine.com/wp-content/uploads/elementor/thumbs/COW-12-18-2023-2iStock-913114646-scaled1-r9s7dyj1lpll5u3yob2us47rf9s9vispl5mxonxh9o.jpg)