The Bottom Line: A declining rate environment should continue to favor conventional and sustainable bond funds, including green bond funds, especially with longer weighted maturities.

Observations:

Weaker than expected data last week accelerated sell-off in stocks but raises likelihood of rate cut

Last Friday’s weaker than projected jobs report and mixed earnings by technology companies accelerated the sell-off in large cap, medium cap and small cap stocks across most sectors. The combination of a hiring slowdown along with a rising unemployment rate and renewed concerns about an economic slowdown increased the likelihood that the Federal Reserve Bank, which held rates steady last week, are expected to lead to a Fed rate cut in September.

Continued rate declines should favor bond funds

For the week, the S&P 500 gave up 2.06%, the Nasdaq 100 dropped 3.06% and the Russell 2000 recorded a sharp 6.67% decline that erased about two-thirds of the gains generated in July. At the same time, 10-year Treasury yields dropped to 3.80%, a 29-bps fall since the end of July when yields stood at 4.09%. Continued rate declines should favor bonds and bond funds, especially longer dated bonds. Anticipation of lower rates, even before yields started to decline, has already rekindled investor interest in bond funds. According to the Wall Street Journal “U.S.-listed fixed-income exchange-traded funds have taken in nearly $150 billion through late July, a record through this point in a year. When looking at mutual funds and ETFs together, taxable bond funds were responsible for nearly 90% of net U.S. fund inflows in the first half, according to Morningstar.”

A declining rate environment should continue to favor bond funds with longer average weighted maturities, including green bond funds

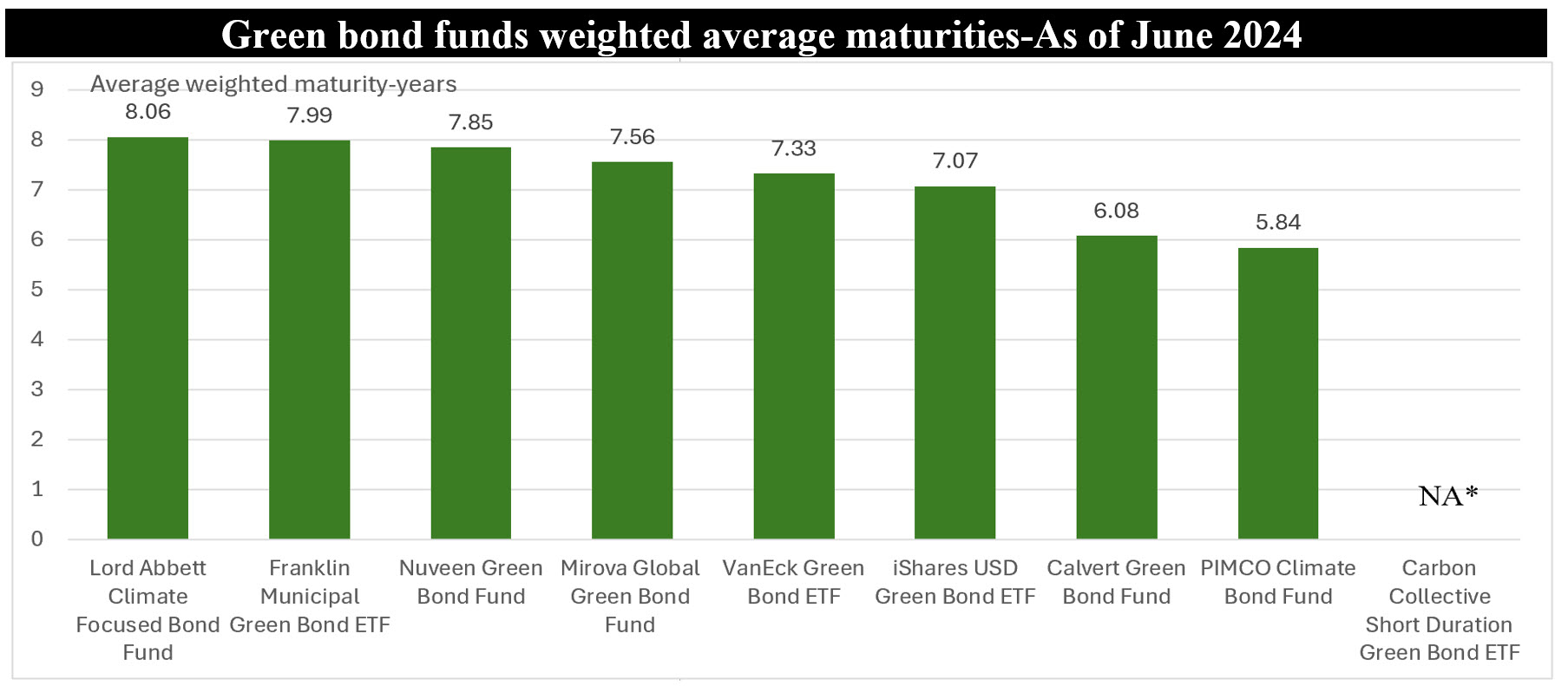

A declining rate environment should continue to favor conventional and sustainable bond funds, especially bond funds with longer average weighted maturities. This will also apply to green bond funds, a sustainable thematic segment consisting of nine mutual funds and ETFs//29 share classes with $1.6 billion in net assets that invest in green bonds or bonds whose proceeds are exclusively applied to projects or activities that promote climate or other environmental purposes.

Lower interest rates should favor green bond funds

On a year-to-date and trailing 12-month basis, green bonds funds have already posted average returns of 2.07% and 5.11%, respectively, 2.78% and 3.52% more than the Bloomberg US Aggregate Bond Index that posted 0.95% and 2.63% over the same time intervals. Over the intermediate term, the average performance of this segment has also beaten the broad-based intermediate investment grade benchmark. Further declines in interest rates should favor this segment given the average weighted maturity of the funds that comprise this category of active and passively managed mutual funds and ETFS. The average weighted maturity of the segment is 7.2 years, ranging from the PIMCO Climate Bond Fund low of 5.8 years to a high of 8.06 years reported for the Lord Abbett Climate Focused Bond Fund. That said, both funds are still small at $19.6 million and 20.9 million, respectively. In addition to fund size and alignment of sustainable investing preferences, investors should consider the management company, years in operations, performance track record and expense ratio, just to mention some of the key investment factors.