Observations:

Focused sustainable assets under management attributable to mutual funds and ETFs experienced modest gains Y-T-D

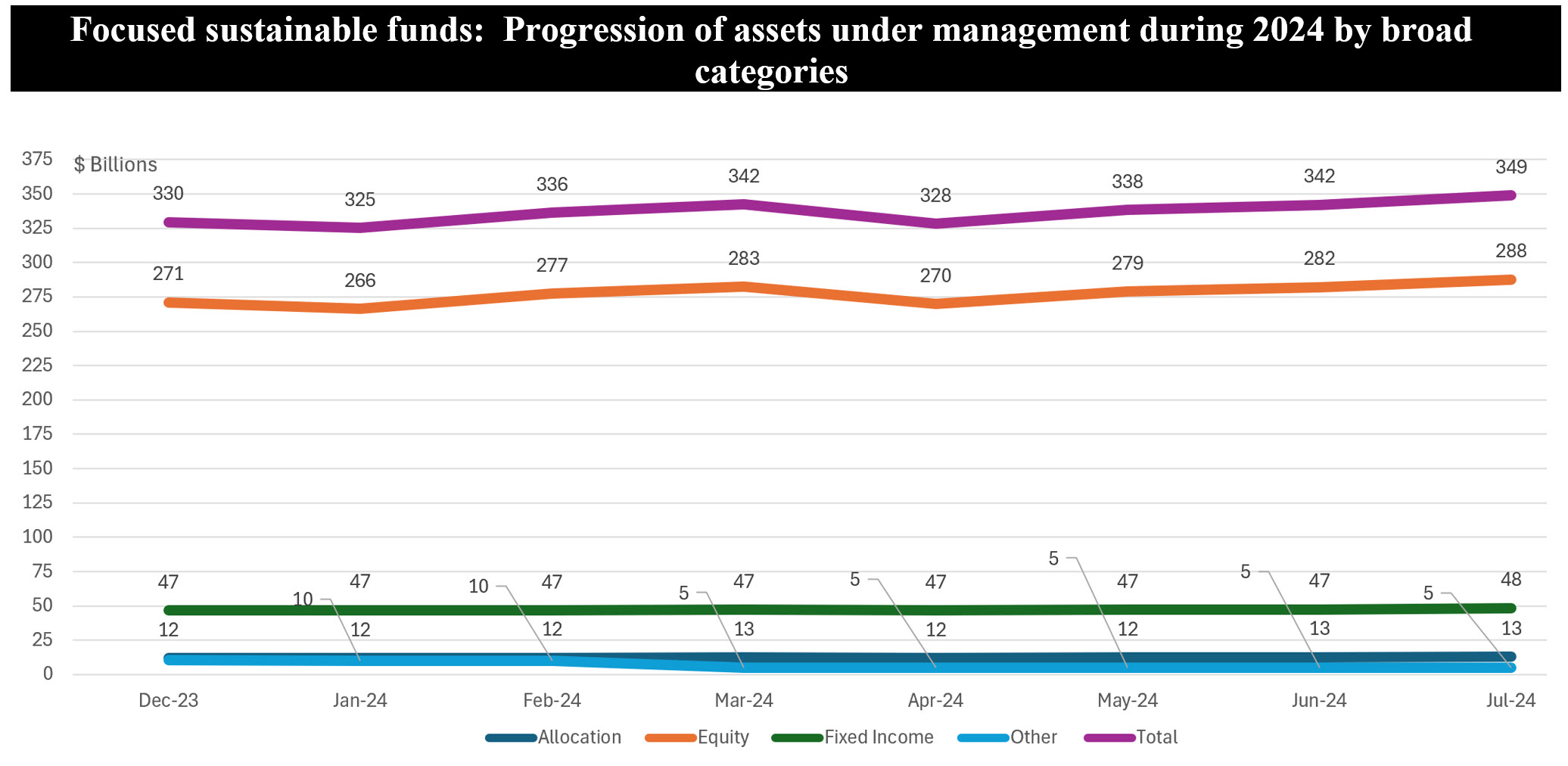

Focused sustainable assets under management attributable to mutual funds and ETFs, 1,467 funds/share classes in total, based on Morningstar classifications, closed the month of July at $353.7 billion in net assets. This represents a modest increase of $13.7 billion in net assets so far this year, for a year-to-date net gain of 5.8%. Since sustainable funds gained an average total return of 7.7% during this interval, it seems that the net increase in assets was due to market appreciation, offset by cash outflows.

Much of the gain Y-T-D was experienced by equity funds

Much of the gain was experienced by equity funds, a segment that accounts for 82% of focused sustainable assets under management. Equity funds gained $16.6 billion in net assets since the start of the year, or an increase of 6.1%. The increase is likely attributable to market gains. Still, the market share of equity funds remains unchanged so far this year.

Assets of sustainable fixed income added a net of just $1.7 billion or 3.6%

Assets of fixed income funds, with a share of 14% that also did not change during the year, added just $1.7 billion so far in 2024, or 3.6%. While conventional bond funds have seen a run of inflows on the back of improved steadier fixed income returns, according to Morningstar, this has not been the case for focused sustainable fixed income funds.

The Other category, a combination of three categories, experienced a net decline due to money market funds

The Other category of sustainable funds, consolidated for presentation purposes, combines Commodity, Money Market and Miscellaneous fund categories, is the only category to have experienced a net decline in assets over the last seven months, shifting downward from $10 billion to $5 billion at the end of July as each one of the underlying categories sustained a Y-T-D drop in assets. That said, the across-the-board decline is almost entirely attributable to the drop in the number of focused sustainable money market funds due to fund closures. Sustainable money market funds tracked by Morningstar have been reduced to just one BlackRock money market fund offering, with assets dropping from $10 billion to $4 billion, as retail and institutional investors have been switched out to other sustainable money market fund options beyond focused money funds. Instead, assets have are being invested in funds/share classes that systematically integrate financially material ESG factors into their investment decisions (along with other relevant factors) with the goal of managing risk and improving long term returns and/or offer dedicated share classes that screen out particular types of sectors or companies or that meet specific sustainable investment goals, such as social goals.

Also closed was the Direxion Dollar Global Clean Energy Bull 2X Shares, classified as a Miscellaneous fund, leaving just one fund in the category as of July 31.