The Bottom Line: Returns from sustainable and conventional bond funds have been disappointing, but investing opportunities are available and improvements may come later this year.

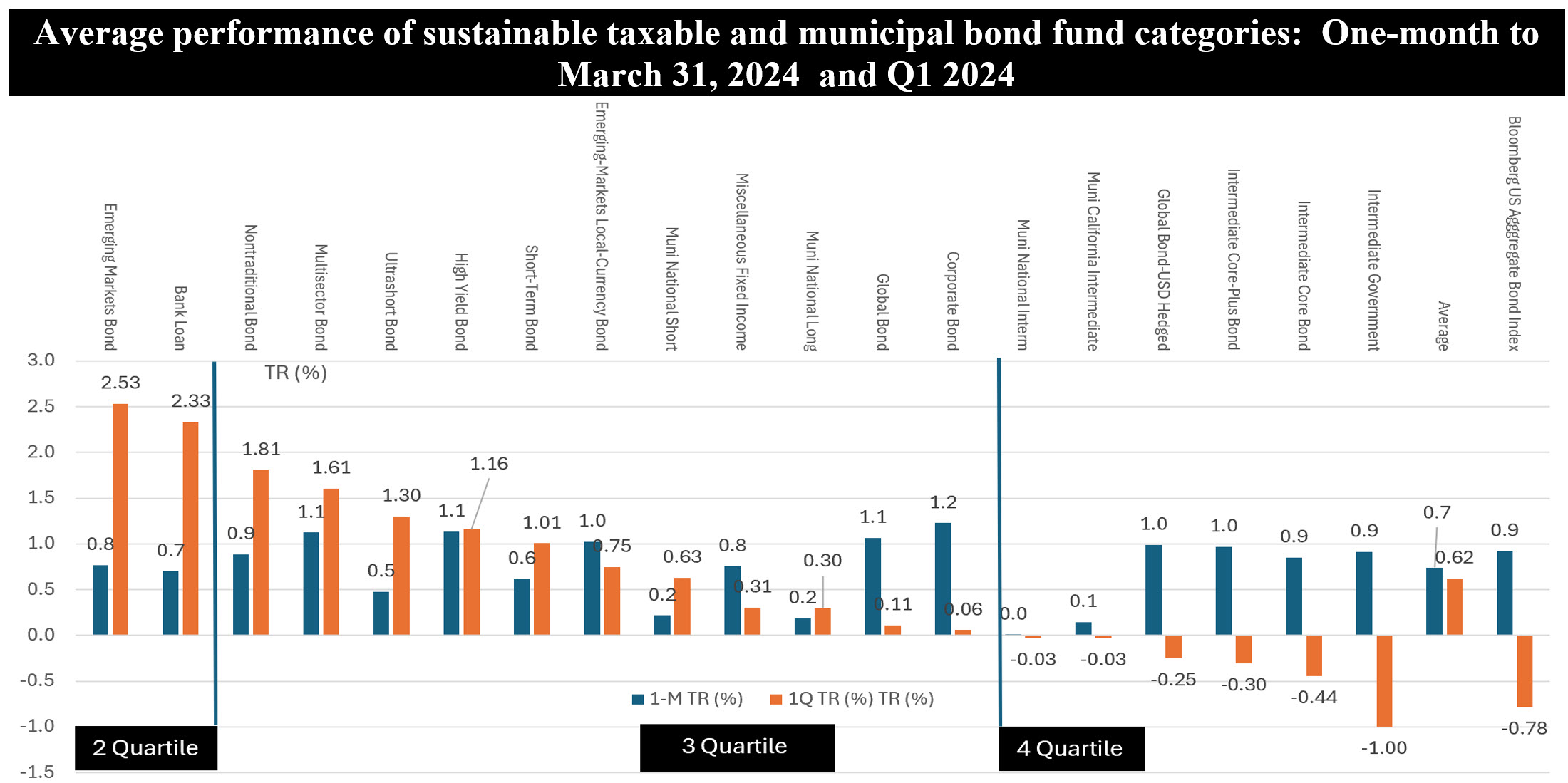

Notes of explanation: Performance of sustainable bond fund categories, 19 in total, listed in order of first quarter 2024 average total returns. Quartile rankings are based on Q1 2024 results. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

- Bonds and bond funds were supposed to produce strong returns in 2024. After dropping about 13% in 2022, the Bloomberg US Aggregate Bond Index gained 5.5% the following year due to robust results in November and December of 2023, when the Bloomberg US Aggregate Bond Index returned 4.5% and 3.8%, respectively. The expectations were for even better results in 2024.

- So far this year, bonds and bond fund returns have been disappointing, as bond yields moved up in response to increasing concerns regarding the stubbornness of inflation which have dimmed the prospects of Federal Reserve rate cuts later this year. Just last week, Federal Reserve Chairman Jerome Powell indicated that persistent high inflation is likely to defer any rate cuts by the Fed until later this year. Chairman Powell expressed caution regarding recent inflation data, stating that it has not instilled greater confidence in the control of inflationary pressures. 10-year Treasury yields that ended the first quarter up 32 basis points since the start of the year added another 42 basis points to end the latest week at a yield of 4.62%. 2-year Treasury notes ended at 4.97%.

- With two exceptions, the average returns recorded by 19 sustainable bond fund categories in the first quarter placed them between the lowest to next to lowest quartiles within the universe of 75 sustainable fund categories tracked by Morningstar. Overall, these funds registered an average return of 0.7% in March and an average of 0.6% during the first quarter. Average returns ranged from a high of 2.53% to a low of -1.0%. Of these, six fund categories registered negative average returns in the first quarter.

- The two exceptions included Emerging Market Bond funds and Bank Loan funds that generated average first quarter returns of 2.5% and 2.3%, respectively. Otherwise, the remaining 17 taxable and municipal sustainable bond fund categories achieved average returns ranging from a low of -1.0% posted by Intermediate Government funds to +1.8% attributable to Nontraditional Bond funds. Individual fund returns within these categories ranged from a high of 2.63% posted by the Ashmore Emerging Markets Corporate Income ESG Institutional Class (expense ratio=0.87%), a fund that integrates and screens environmental, social and governance (ESG) factors and employs exclusions, to a low of -1.37% recorded by BlackRock Impact Mortgage Investment Fund Class C subject to a 2.59% expense ratio. In selecting securities, the fund considers whether the activities supported by the investment are expected to include positive social and/or environmental impact with measurable and clear benefit to undercapitalized or high social opportunity areas and alignment with broadly endorsed public policy goals. Refer to the SRI Funds Directory for additional details regarding the sustainable investment approaches employed by these two funds.

- While returns from sustainable and convention al bond funds so far this year have been disappointing, “higher for longer” rates means that attractive investing opportunities are likely to be available in the bond market, in any case. Further, returns should improve when the Federal Reserve finally does move forward with rate cuts that are still expected later this year.