Summary/Introduction

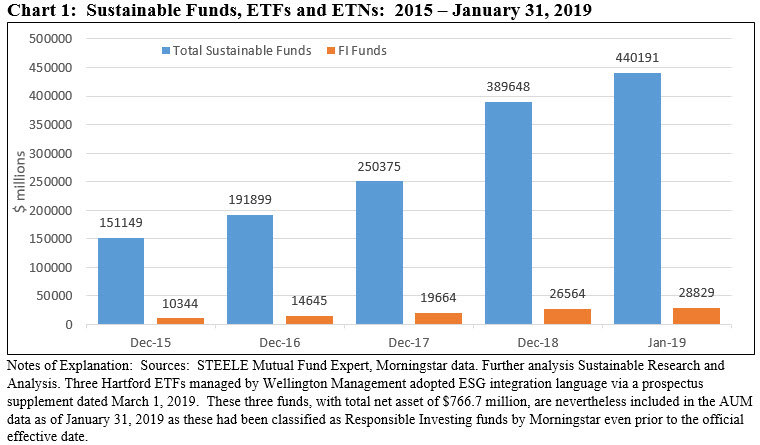

In the last four years or so, sustainable bond mutual funds nearly tripled in number and experienced an expansion in assets from $10.3 billion to $27.6 billion, or an increase of 167%. In addition 14 fixed income sustainable exchange-traded funds (ETFs) with another $1.2 billion in assets are now listed and available[1]. These ETFs have all been introduced in just the last two years. Even with a combined total of almost $30 billion, this compares to $411.4 billion in assets sourced to self-designated sustainable equity funds and ETFs as of January 31, 2019, or only 6.8% of sustainable fund assets. Refer to Chart 1. By way of further contrast to the long-term mutual fund and ETF industry at about $18.1 trillion as of t year-end 2018, long-term fixed income funds, both taxable and municipal, at about $4.7 trillion in net assets, represent 25% of long-term mutual fund assets. Moreover, the growth rate in sustainable fixed income products and assets has lagged behind equity and equity like funds since 2014. Still, the fixed income sustainable fund segment has been changing and evolving. In addition to the growth and expansion in the number, type and fixed income assets under management (AUM) as investors broaden the application of sustainable investing strategies beyond equities, some of the notable recent developments in sustainable fixed income investing, when viewed through the prism of mutual funds and ETFs, include: (1) The growth of the segment due to the entry of mainstream investment managers and the rebranding of existing fixed income funds. This is contributing to growth in the sector which is not as yet being turbocharged by net new money, especially form retail investors, (2) The important role of institutional investors whose assets account for about 76% of the mutual fund assets in the segment, (3) the broadening of offerings to include environmental, social and governance (ESG) qualified investment-grade intermediate term bond portfolio options that, in turn, facilitates asset allocation and diversification, (4) the introduction of additional ESG money market funds and short-term funds, (5) a doubling in the number of green bond funds, and (6) the shifting emphasis from values-based strategies to ESG integration that also imbeds negative screening. It is highly likely that fixed income funds, both taxable and tax exempt, will continue to expand in number as well as assets, potentially at an even greater pace than in the past. At the same time, the unique challenges that arise in the process of integrating ESG in fixed income due to some of the added complexities introduced by fixed income instruments, above and beyond considerations affecting all asset classes, namely data availability or reliability, negative impact on performance and investor education, will also have to be addressed by the various fixed income market participants.

Fixed Income Mutual Funds Today: 76 funds with $27.6 billion in AUM

There are a total of 76 active and passively managed short-term and long-term taxable and municipal mutual funds, representing 234 share classes and a total of $27.6 billion in assets under management. These funds are offered and/or managed by 41 firms as compared to 29 firms as of December 31, 2017, a period of just 13-months. The average fund family manages $674.5 million in sustainable assets while only eight fund firms can boast of managing $1+ billion in sustainable fixed income assets. 76% of the assets are sourced to institutional investors.

Fund firms: 41 fund firms with top ten firms accounting for 82.4% of AUM

The largest firms dominate, as the largest 10 fund firms manage $22.8 billion in AUM and account for 82.4% of the fixed income segment’s assets. Adding the next 10 largest ranked fund firms expands the AUM number by an additional $3.4 billion and brings the total to $26.2 billion or 95% of the segment’s assets under management.

The ranking of the top 10 and top 20 firms changed in 2018 as mainstream investment management firms rebranded existing fixed income funds by amending their prospectuses and shifted their assets into the sustainable segment. In the process, these firms ascended into the top sustainable fixed income fund ranks. These firms include American Century Investments, Morgan Stanley, Shenkman Investment Management, Aberdeen and DWS (formerly Deutsche Bank).

The remaining 21 firms manage about $1.5 in assets, accounting for 5.3% of the segment’s assets under management.

Bond fund types: Investment-grade intermediate funds that track the Bloomberg Barclays US Aggregate Index dominate

Using a traditional classification approach based on investment mandates, almost $13 billion in assets, or 47%, is invested in intermediate corporate bonds. Short-term bond funds account for another $3.4 billion, or 12.2% and intermediate government bond funds add another $2.5 billion, for a total of $18.8 billion or 68.2%. With the launch by DWS of an institutionally oriented money market fund, and before BlackRock’s newly announced money fund kicks in with some assets, this category now ranks fourth in terms of AUM. Green bond mutual funds, of which there are now four, are captured under the World Funds category.

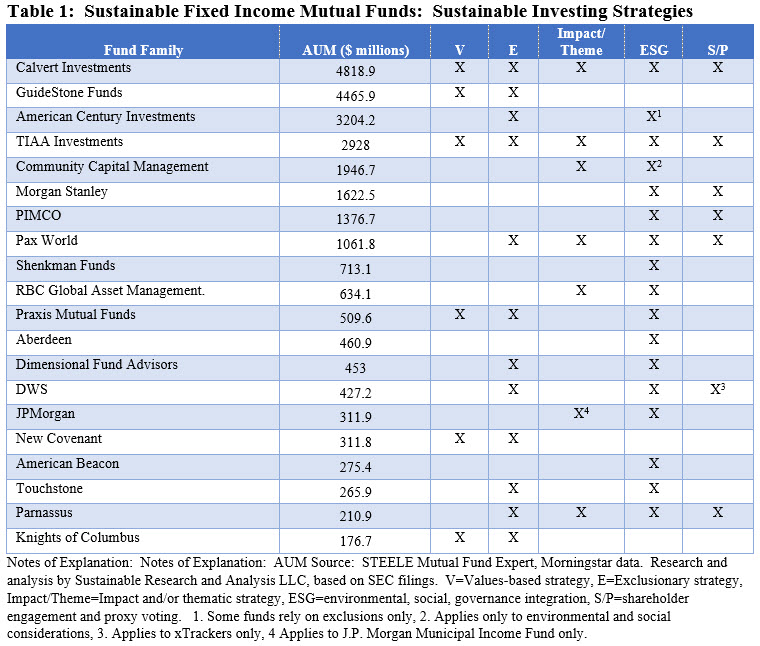

Sustainable strategies of funds: ESG integration combined with negative screening rule the segment

Table 1 identifies the sustainable investing strategies employed by the top 20 fund groups in the sustainable fixed income segment. While there may be variations across some funds within a fund group which have been identified in the notes of explanation, the table reflects the most widely applicable sustainable investing strategies applicable within a fund group, based on a review of the underlying funds’ SEC filings.

Except for three firms, ESG integration reflects the most commonly used sustainable investing strategy and this approach is typically paired with some level of negative screening or exclusions. With regard to ESG integration, there is no standardized methodology that applies and information inputs can vary. Three ESG integration approaches that are common include reliance on ESG scores generally, selecting from companies and/or securities that have achieved minimum ESG scores, and investing in best in class companies and/or securities based on ESG scores. These strategies may also be paired with an emphasis on firms/securities with ESG scores that are trending up, driven by research suggesting that this approach can lead to outperformance.

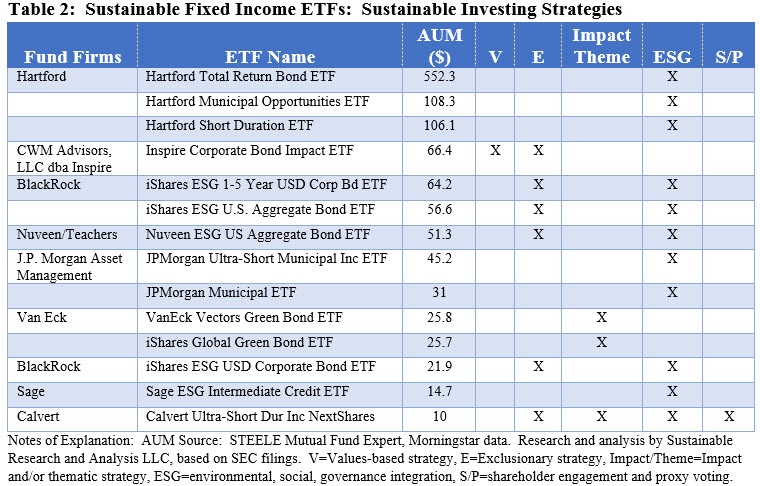

ETFs and ETNs: 14 Sustainable Fixed Income ETFs with $1.2 billion in AUM

14 sustainable ETFs are currently listed for trading, with $1.2 billion in assets under management as of January 31, 2019. These are offered by eight firms, one of which repurposed three existing funds effective on March 1[1].

In total, these repurposed funds shifted $766.7 million in assets or 65% of AUM. Rebranded funds aside, five of the current ETF offerings were launched in 2018. The average ETF size stands at about $84 million.

All but three funds employ an approach that relies on ESG integration, for a total of 11 funds with about $1.1 billion in assets, or 90%. Typically, this strategy may also be accompanied by negative screening. Refer to Table 2. Two ETFs invest in green bonds, bringing to six the total number of funds that invest in green bonds.

Performance of actively managed sustainable fixed income mutual funds

A limited number of offerings, a variety of sustainable strategies combined with short operating histories makes the task of evaluating segment performance, rather than individual fund performance, more difficult at this time. In most categories, there are a limited number of funds to evaluate, however, this is not the case for the investment-grade intermediate segment that was transformed in 2018 into the largest grouping within sustainable fixed income due to the expansion in the universe of similarly managed funds, as noted previously. This has made possible the creation of an index to track like funds.

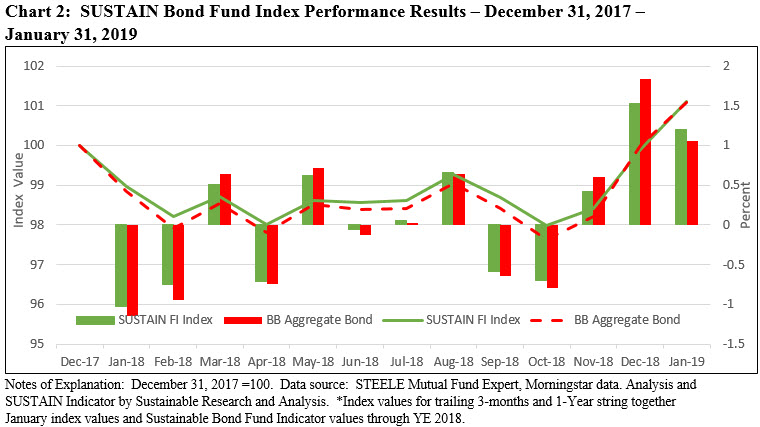

That’s the idea behind the creation of the Sustainable (SUSTAIN) Fixed Income Index, a benchmark that tracks the total return performance of ten actively managed sustainable fixed income funds that are pursuing investment-grade intermediate term mandates in line with the Bloomberg Barclays US Aggregate Index while at the same time employing a sustainable investing ESG integration strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. Effective December 31, 2018, the SUSTAIN Fixed Income Index was reconstituted with the expansion of available funds from five to the ten largest qualifying funds. Prior to December 31, 2018, this benchmark was comprised of only five funds and was referred to as the Sustainable (SUSTAIN) Bond Fund Indicator.

In 2018, the SUSTAIN Bond Fund Indicator posted a slight total return decline of -0.05% versus a gain of 0.01% for the Bloomberg Barclays US Aggregate Index, for a fractional 0.06% difference. In January 2019, however, the reconstituted SUSTAIN Bond Fund Index posted an increase of 1.2%, exceeding the Bloomberg Barclays US Aggregate Index by 15 basis points as positive contributions to the outperformance of the index were made by six funds that achieved excess index returns. Combining data for the 13-month interval through January 31, 2019, January’s strong results allowed the SUSTAIN Bond Fund Index to record a 13-month return of 1.1% versus 1.07% for the Bloomberg Barclays US Aggregate Index, for a positive 0.04% differential. Refer to Chart 2.

Five unique challenges for fixed income investors

In addition to the ESG integration challenges faced by all investors, as referenced previously, applying ESG integration to fixed income securities introduces additional complications and unique considerations that have to be addressed by fixed income managers. The key ones are, the following:

1. Company versus security level ESG scoring or rating. Structural variations that range from senior unsecured obligations to project finance and structured transactions, such as ABS or CLOs, that are not necessarily reliant on the company or issuer for repayment, means that a company level ESG score may not be relevant and a transaction specific assessment may be required.

2. Treatment of time horizon in the evaluation of securities. Depending on the risk/opportunity consideration, shorter-dated securities may be subject to lower or greater risks of default or rating transitions. For this reason, the ESG risk profile of an individual transaction may have to be decoupled from that of the issuing company.

3. Evaluating ESG risks of structured securities. Evaluating the ESG risks and opportunities of ABS transactions or CLOs, for example, likely requires an examination of the underlying collateral and possibly the various servicing entities involved in the transaction.

4. Limited disclosures. While data availability and reliability affects all asset classes, it is especially pronounced for municipal entities, private firms, non-investment grade entities, structured securities and emerging market entities.

5. Treatment of derivatives. Extensive reliance on derivatives in fixed income portfolio management and their treatment under an ESG assessment framework means that frameworks for addressing derivative instruments will have to be developed.

[1] Three Hartford ETFs managed by Wellington Management adopted ESG integration language via a prospectus supplement dated March 1, 2019. These three funds, with total net asset of $766.7 million, are nevertheless included in the AUM data as of January 31, 2019 as these had been classified as Responsible Investing funds by Morningstar even prior to the official effective date.

[2] Refer to footnote 1.