BlackRock, in letter to clients, commits to greater transparency and disclosure that could, in turn, raise the bar for sustainable investment fund disclosures generally and stimulate the development of industry-wide definitions and standards

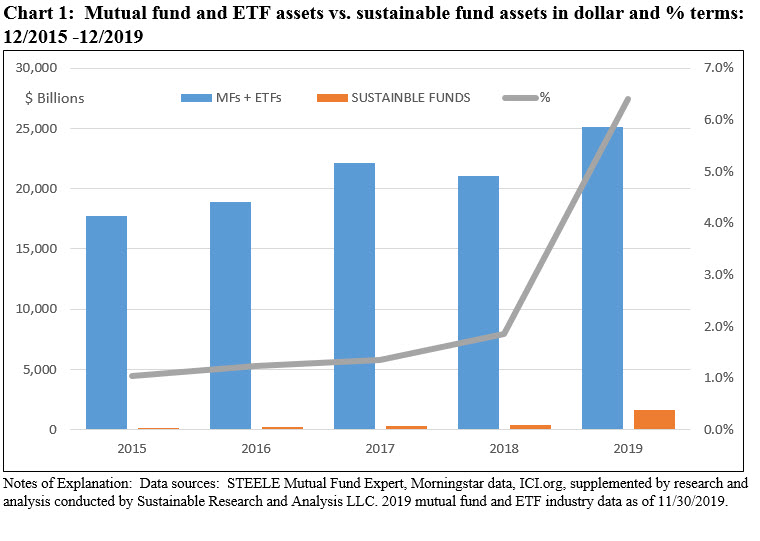

Sustainable investing(1) may be reaching a critical juncture. Assets in mutual funds and ETFs in the US sourced to sustainable investing strategies reached $1.6 trillion at the end of 2019 and now comprise around 6.4% of mutual fund and ETF industry assets. In mid-January, world leaders and company CEOs attending the World Economic Forum in Davos rallied around a consensus that accelerating global warming poses a significant risk to society and to businesses. Also just two weeks ago BlackRock’s Chairman and CEO Larry Fink, in a letter to clients dated January 14, wrote about the importance of sustainability and climate change to investment outcomes and he set out an action plan to integrate sustainability more deeply into BlackRock’s investment and risk management processes. According to the letter, BlackRock is making sustainability integral to how the firm invests, manages risk, constructs portfolios, builds products and engages with companies. It also intends to step up its sustainable investing disclosures to investors and enhance the transparency of the firm’s stewardship practices. These actions on the part of a company with global scale and reach that now manages $7.4 trillion in assets under management will further accelerate the significant growth in the sustainable investment segment that was observed through the end of 2019; and these initiatives will likely raise the bar in terms of sustainable investing disclosure practices. BlackRock’s actions could also stimulate the development and adoption of widely accepted sustainable investing definitions and standards. In the process, this will contribute to reduced confusion regarding the various forms of sustainable investing approaches and strategies.

Assets Growth: BlackRock’s actions will further accelerate the significant growth in the sustainable investment segment that reached $1.6 trillion at YE 2019

The total net assets of mutual funds and exchange-traded funds (ETF)(2) sourced to sustainable investing approaches expanded dramatically in 2019, reaching $1.6 trillion at the end of the year. This represents an increase of $1.2 trillion or 313% from $390.4 billion at year-end 2018, fueled largely by fund re-brandings, followed, but to a much less significant extent, by market movement and net new money.

Sustainable mutual fund and ETF assets have gained considerable traction starting in 2016. In the last five years, assets added $1.4 trillion or 88% of the 5-year growth total. Accounting for just about 1.0% of mutual fund and ETF industry assets at the end of 2015, this segment expanded to 1.85% of industry assets at the end of 2018 and jumped to 6.4% at the end of 2019. Refer to Chart 1.

It’s not coincidental that this interval followed the signing of the Paris Climate Agreement of 2015 (COP 21). But in addition to heightened sensitivity to climate change and the risks and opportunities associated with this universal threat and all its implications, other factors also influenced the growth. Not in any particular order, other contributing factors include worrisome societal trends such as gender and income inequality, gun violence, water scarcity, poverty, migration, education and a perceived deterioration in corporate governance standards that many believe contributed to the financial crisis beginning in 2008. Prompted by governments, regulators, businesses, investors and customers, the recent evolution in sustainable investing is informed by the view that the achievement of positive societal outcomes via sustainable finance is consistent with long-term value creation. Put another way, investors can achieve, at minimum, market-based financial results while also having a positive impact on society.

The number of firms offering sustainable fund products, fund offerings and types as well as investors also increased significantly. In the process, investors and the allocation of sustainable assets across fund types and sectors shifted markedly as did the dominant form of strategies pursued by leading investment firms and their fund offerings. This has contributed to the confusion that has arisen with regard to the meaning of certain strategies and expected outcomes, in particular as environmental, social and governance (ESG) integration overtook socially responsible investing practices.

BlackRock client letter commits to a substantial list of product innovations and disclosure enhancements

In its letter to clients, BlackRock committed to a substantial list of new product innovations, including making sustainable funds the standard building blocks for the firm’s multi-asset investment solutions. In addition, BlackRock promised to make several future disclosure enhancements. In this particular area, BlackRock noted that it wants “investors to be able to clearly see the sustainability risks of their investments.” For its sustainable iShares ETFs, BlackRock already publishes various ESG metrics such as ESG quality ranks and scores, carbon footprint measures, gender diversity, exposure to companies involved in controversial activities and sustainable impact based on portfolio alignment with the UN’s Sustainable Development Goals (SDGs). Apparently, this type of reporting will be extended beyond iShares ETFs. By the end of 2020, BlackRock intends to “provide transparent, publicly available data on sustainability characteristics – including data on controversial holdings and carbon footprint – for BlackRock mutual funds.” This will apply to all clients, including those in separate accounts.

Further, BlackRock is committed to enhancing the transparency of its stewardship practices. Starting in the first quarter of 2020, the management company will shift from annual to quarterly voting disclosure. On key high-profile votes, the firm will disclose its vote promptly, along with an explanation of its decision. Also, BlackRock will enhance the disclosure of company engagements “by including in our stewardship annual report the topics we discussed during each engagement with a company.”

Actions by BlackRock are expected to raise the bar for sustainable investing disclosure practices industry-wide

In addition to greater disclosure and transparency covering its own investment product offerings, BlackRock’s commitments will likely raise the bar for sustainable investing disclosure practices industry-wide. BlackRock’s actions could also stimulate the development and adoption of widely accepted sustainable investing definitions and standards that, in the process, leads to a desirable and much needed reduction in the confusion surrounding various sustainable investing approaches and strategies.

Repeating previous comments made by Sustainable Research and Analysis, a commonly accepted definition of sustainable investing and some of the various strategies that are encapsulated in this overarching term do not exist today and asset owners, asset managers, issuers, retail investors, regulators and various other market practitioners are not synchronized regarding what some of the strategies mean. For example, an industry-wide commonly accepted definition of ESG integration does not exist. One consequence of this is that there is confusion between varying strategies and approaches that make up the sustainable investing landscape, in particular by conflating ESG funds or ESG funds that integrate ESG and values-based investing and negative screening or exclusionary approaches. This muddying up of two unlike sustainable investing approaches has also crept into the day-to-day conversation and unless checked, is likely to deter investors, in particular individual investors, lead to disappointment on the part of clients of all types, and expose asset managers to potential reputation risk, regulations and worse, financial liabilities.

Regardless of sustainable investing approach, disclosures are key

It should also be noted that sustainable investing approaches are not mutually exclusive and some managers combine one of more methods. Regardless of the approach or products offered, however, it is key for investment management firms to offer investors who are attracted to sustainable investing a clear explanation of their approach and strategies, how such strategies are implemented, their impact on investment decision making and outcomes, both from a financial return point of view and, to the extent possible, in terms of social, environmental and governance outcomes. The same applies to all financial and related fund reports. Solidifying such disclosures, however, requires the development of an industry-wide taxonomy consisting of terms and definitions.

(1) While the definition of sustainable investing continues to evolve, this refers to a range of overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing, environmental, social and governance (ESG) integration, company engagement and proxy voting. These are not mutually exclusive.

(2) Also includes a small number of exchange-traded notes (ETNs).