The Bottom Line: Sustainable investors can choose from an increasing number of sustainable mutual funds/share classes and ETFs that are now offered by 165 firms.

0:00

/

0:00

Listen to this article now

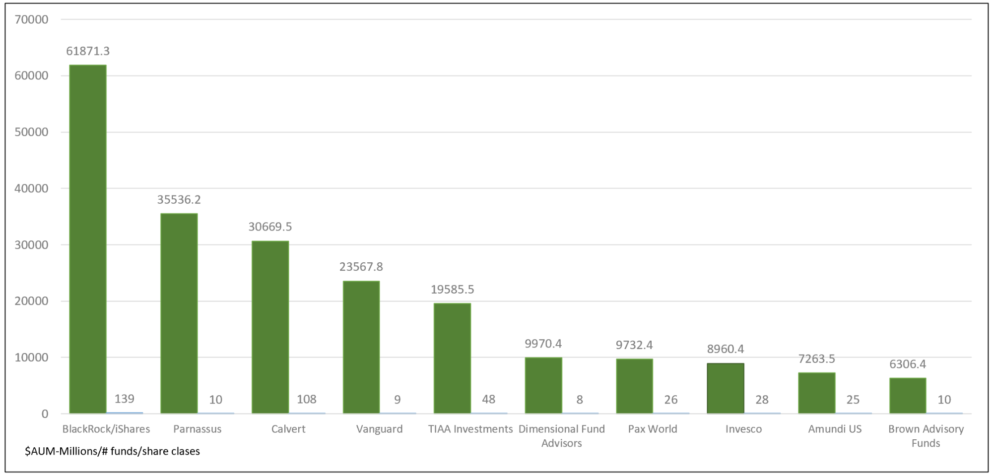

Ten largest management firms offering sustainable mutual funds and ETFs Notes of Explanation: Where applicable, assets of affiliated firms are consolidated. Assets as of December 31, 2022. Source: Morningstar Direct and Sustainable Research and Analysis LLC

Notes of Explanation: Where applicable, assets of affiliated firms are consolidated. Assets as of December 31, 2022. Source: Morningstar Direct and Sustainable Research and Analysis LLC

Observations:

- Sustainable investors can choose from an increasing number of sustainable mutual funds/share classes and ETFs that are now offered by at least 165 firms with $300.4 billion in assets as of year-end 2022. These firms offer a combined total of 1,348 sustainable investment mutual funds/share classes and ETFs. These now include a growing selection of actively managed funds as well as index funds that pursue various forms of sustainable investing approaches ranging from values-based investing to thematic investing, impact investing and ESG integration.

- The segment is concentrated, with the ten largest firms accounting for $213.4 billion or 71% of assets under management.

- The largest firm offering sustainable investment funds is BlackRock that together with its mutual funds and ETFs manages $61.9 billion in assets across 139 funds/share classes. Most of these are in the form of passively managed ETFs that make up 89% of the firm’s sustainable fund assets. On the other hand, the second largest firm, Parnassus with its 10 funds/share classes (5 funds), only offers actively managed investment options. At the other end of the range, just about 50% of firms manage less than $100 million in sustainable fund assets.

- Passively managed sustainable investing options, 197 in total, are available from 42 managers. This segment makes up $116.4 billion or 39% of assets.

- Within the segment of the ten largest sustainable fund firms, expense ratios vary with average weighted expense ratios ranging from the lowest applicable to Dimensional Fund Advisors and Vanguard of 29 bps and 33 bps, respectively, to the highest levied by Amundi US at 1.07% to an average of 93 basis points charged by Calvert Research and management.

- In addition to confirming alignment with their sustainability preferences, investors interested in active management, recognizing that few active managers outperform securities market indices, should seek out funds with a sufficiently long management, financial and sustainable investing track record, usually three + years, reasonably sized funds and low expense ratios. Expense ratios for actively managed funds can be twice as high as their passively managed counterparts, if not higher. As for index funds, in addition to the factors noted above, follow-on considerations include the potential impacts of securities lending and currency exposures, to the extent applicable.