Since the announcement on August 11 and successful placement of Tesla’s $1.80 billion Senior Notes, some disappointment has been expressed by the fact that Tesla didn’t formally qualify as green the company’s newly issued notes. It was suggested that issuing designated green bonds (or notes, in this instance) would have been a way to highlight Tesla’s obvious green credentials for the benefit of an investment community that’s thirsty for green bonds. A formal green bond designation would certainly have been noteworthy, especially in the U.S. where there has been and continues to be more limited corporate green bond issuance. A green bond label for a high-profile issuer like Tesla would have also served to sustain and even elevate awareness of climate change risks and needed mitigation efforts, particularly given the recent environmental policy shifts in the U.S. Moreover, such a designation would have potentially qualified the bonds for investment by a larger segment of the sustainable investing universe, consisting of various actively and passively managed funds and separate accounts, which is being hamstrung by limited supplies of green bonds. In the first half of 2017, about $49.1 billion in green bonds have been issued. That said, it seems difficult to argue that Tesla’s notes, and other fixed-income instruments with similar profiles, are not green, on their face, even if the offering does not embrace the Green Bond Principles, a set of voluntary best practice guidelines that have been widely adopted to qualify green bonds. After all, Tesla is on a mission is to accelerate the world’s transition to sustainable energy and it is leading an electric automobile revolution that could eventually bring about a material reduction in greenhouse gas emissions. This argues that even if the bonds are not formally designated as green, the Tesla notes, and other bonds with similar profiles, should be considered as such by investors.

Tesla’s Sustainable Background

On August 11, 2017, Tesla, Inc. agreed to issue and sell $1.80 billion aggregate principal amount of 5.30% Senior Notes due 2025 in the United States to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended, and outside the United States to non-U.S. persons pursuant to Regulation S under the Securities Act. The notes are senior unsecured debt obligations of the company and will initially be guaranteed on a senior unsecured basis by SolarCity Corporation, a wholly-owned subsidiary of Tesla. The company intends to use the net proceeds from this offering to strengthen its balance sheet during the period of rapid scaling with the launch of Model 3, and for general corporate purposes. The obligations are considered non-investment grade, having been assigned a B3 rating with a stable outlook by Moody’s Investors Service.

What are Green Bonds?

Green bonds are equivalent to other fixed income securities, both taxable and tax-exempt, except that these types of bonds or other similar debt instruments raise funds specifically to finance new and existing projects with environmental benefits. Green bonds are generally issued pursuant to a set of voluntary guidelines or a set of best practices in the form of a framework known as the Green Bond Principles (GBP) . The GBP, which emphasize disclosure and transparency, includes criteria for the use of proceeds, the issuer’s process for project evaluation, the management of proceeds and reporting both at the time of issue and on a periodic basis thereafter. Still, there are variations around the interpretation and application of these Green Bond Principles that may lead to some uncertainties. The offerings can be informed and the potential uncertainties can be mitigated, but not eliminated entirely, by relying on external independent reviews for assurances or certifications which are recommended but not required by the GBP. Organizations like Climate Bond Initiative, CICERO (Center for International Climate & Environmental Research-Oslo), Moody’s Investors and Sustainalytics, to mention just a few, offer such external reviews. About two-thirds of green bonds globally come to market with the benefit of such independent reviews.

Green Bonds Project Categories

Green bond proceeds may be used to finance a variety of project categories aimed at addressing key areas of concern such as climate change, natural resource depletion, and loss of biodiversity and/or pollution control. While not limited to these, the following categories will generally qualify for the ultimate investment of proceeds: renewable energy, energy efficiency, pollution prevention and control, sustainable management of living natural resources, terrestrial and aquatic biodiversity conservation, clean transportation, sustainable water management, climate change adaptation, and eco-efficient products, production technologies and processes.

Green Bonds Uniquely Suited to Finance Environmental Risk Mitigation and Adaptation Initiatives

Financial considerations aside, for investors focused on supporting the Paris Climate Agreement objectives of reducing greenhouse gas emissions to levels consistent with holding the increase in the global average temperature to well below 2° Celsius relative to pre-industrial levels, and who focus on environmental risks and opportunities, in particular, green bonds are uniquely suited to meet their objectives. This is because they are specifically intended to achieve positive environmental and other societal benefits and issuers who qualify their bonds as green make commitments to disclose, in the form of periodic reporting, usually annually, the allocation of proceeds and their expected environmental impacts, either in quantitative and/or qualitative terms. At the same time, their yields, as well as pricing, are in line with any other equivalent bond issued by the same issuer.

Tesla’s Senior Notes

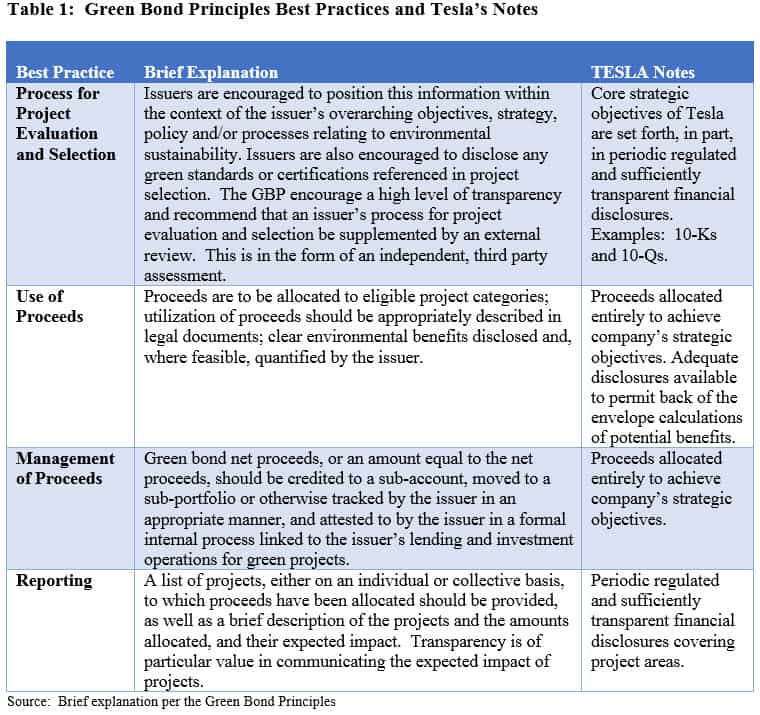

Table 1 summarizes in brief the best practices encapsulated by the Green Bond Principles and the alignment of Tesla’s notes.

Tesla’s Use of Bond Proceeds

As noted above, Tesla did not formally integrate the GBP’s best practices into its offering and as such the company’s senior notes were not qualified as green. That said, Tesla intends to use the net proceeds from this offering to strengthen its balance sheet during the period of rapid scaling with the launch of its Model 3 electric vehicle, a lower-priced sedan designed for the mass market, and for general corporate purposes. The company’s core strategy is to design, develop, manufacture, and sell high-performance fully electric vehicles. It also designs, manufactures, installs and sells solar energy generation and energy storage products and energy products. It is currently producing and selling a Model S sedan and a Model X SUV and the sales of these vehicles represents the firm’s primary source of revenues, even post Tesla’s Solar City merger. Beyond electric automobiles, the company’s other lines of business include alternative renewable energy products for residential and commercial applications, also eligible project categories under the GBP.

Quantifying Environmental Benefits and Impact

While Tesla is not committed to disclosing environmental benefits and impacts in line with the GBP best practices, it’s not difficult for investors to conduct a simplified back of the envelope calculation of the minimum potential environmental benefits associated with its automotive activities alone. For example, according to the Environmental Protection Agency (EPA), the annual estimated emissions sourced to a typical passenger vehicle in the U.S. is 4.7 metric tons of CO2. Assuming that each of Tesla’s electric vehicles displaces a typical combustion engine passenger vehicle, the sale of Model S and Model X vehicles in 2017, conservatively estimated at 94,200 , is already contributing to emissions savings of about 442,740 metric tons of CO2 per year. By the end of 2018, this could be increased to 2.35 million metric tons of CO2 per year, based on Tesla’s optimistic production projections, some hold, and contribute toward the reduction of emissions in the transportation segment that accounts for about 32 percent of total U.S. CO2 emissions.

Conclusions

Financial risk considerations aside, green bonds are uniquely suited to meet the objectives of investors focused on environmental considerations supporting the Paris Climate Agreement objectives of keeping the earth’s surface temperatures from rising above 2° Celsius as well climate-related risks and opportunities. While this may not be the case for all issuers, and in particular bond offerings with limited disclosure, the Tesla notes, even if they were not qualified as green, are consistent with a green mandate and a 2° Celsius scenario. Regrettably, the Tesla notes were only made available to qualified institutional investors and retail investors were excluded from investing in these debt instruments directly. They could, however, do so indirectly through mutual funds and ETFs that might have purchased these notes. At the same time, the broader universe of sustainable investors, including any with ESG mandates, for example, will also have to address any Tesla specific governance and social considerations before deciding to invest in the company’s notes.