The Bottom Line: Sustainable and conventional emerging market debt funds are turning in one of the worst years on record, but conditions may be improving.

0:00

/

0:00

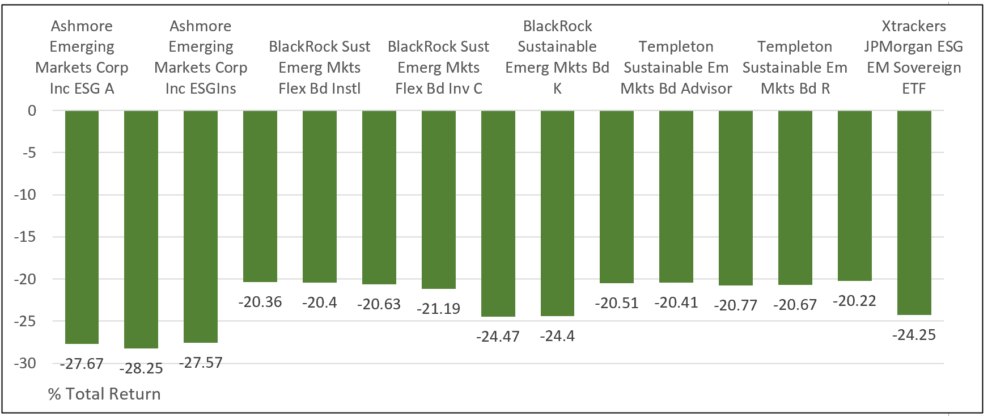

Performance (TR) of sustainable emerging market debt funds: 12-M to October 31, 2022 Notes of Explanation: BlackRock rebranded its two funds at the end of 2021. Templeton Sustainable Emerging Markets Bond Fund rebranded in 2021. Xtrackers JPMorgan ESG EM Sovereign ETF changed its underlying index effective May 12, 2020 to the JP Morgan ESG EMBI Global Diversified Sovereign Index from the Solactive USD Emerging Markets Bond – Interest Rate Hedged Index. Performance data source: Morningstar Direct. Research by Sustainable Research and Analysis.

Notes of Explanation: BlackRock rebranded its two funds at the end of 2021. Templeton Sustainable Emerging Markets Bond Fund rebranded in 2021. Xtrackers JPMorgan ESG EM Sovereign ETF changed its underlying index effective May 12, 2020 to the JP Morgan ESG EMBI Global Diversified Sovereign Index from the Solactive USD Emerging Markets Bond – Interest Rate Hedged Index. Performance data source: Morningstar Direct. Research by Sustainable Research and Analysis.

Observations:

- Sustainable emerging market debt funds are turning in what is widely expected to be one of the worst years on record for emerging markets. The small universe, consisting of four mutual funds with 14 share classes and one ETF, for a combined total of $86.1 million in net assets, emphasizes investments in higher ESG scoring firms or sovereigns and/or momentum in improving ESG scores as well as exclusions and, in the case of BlackRlock, an additional focus on carbon emissions, posted an average return of -22.78. Returns ranged from -20.22% to -28.25%, with the lowest returns attributable to higher levels of exposure to Russia and Ukraine, in particular, at the start of the year that were written down. These results compared to -22.21% posted by the J.P. Morgan Emerging Markets Bond Global Total Return Index and in line with the -21.1% trailing 12-month performance results recorded by conventional emerging market funds, including active and passively managed funds.

- Emerging market debt, which suffered five consecutive quarters of negative returns, was impacted by the COVID-19 pandemic, and then fell sharply in the first half of the year. Investors reacted negatively to Russia’s invasion of Ukraine in February 2022 and the resulting impact on energy prices and global supply chains. Also, stubbornly high inflation prompted the Fed and other central banks to raise interest rates aggressively while repeated lockdowns in China have been weighing heavily on its economy. These factors have affected returns across the entire bond market, with higher-risk categories experiencing the weakest performance. Emerging markets are also potentially facing higher rates of default.

- Returns turned up in November. Also, some firms have begun to raise their outlook for emerging market’s hard currency bonds based on the premise that a slowdown in U.S. rate hikes could provide some breathing space for the embattled asset class. According to a Reuters report issued two weeks ago, JPMorgan raised its outlook for emerging market hard-currency debt to “marketweight” from “underweight.” Also, in its 2023 outlook Morgan Stanley predicted emerging market hard-currency bonds could return more than 14% next year.

- That said, sustainable emerging market debt funds offer investors a very limited set of investment options. The number of fund options is small and they are relatively new (while some funds have been in existence for some time, they have been rebranded in the last two years or so through the adoption of a sustainable investing strategy or index change), the average fund size is just $17.2 million as of October 31st and expense ratios for actively managed portfolios, an average of 1.06%, is high (but not any higher than conventional emerging market debt funds). The only passively managed Xtrackers JPMorgan ESG Emerging Markets Sovereign ETF (ESEB), that charges 35 bps, was launched in 2015. But the underlying index was swapped out in 2020 and the fund has only managed to attract $16.2 million. At this time, a conventional actively managed emerging market debt fund may be the way forward for investors interested in dropping an anchor in this challenging environment.