The Bottom Line: Green bond funds experienced modest outflows during a volatile month and while performance suffered in April, the segment, on average, held up.

April Summary

- Modest outflows during a volatile month for both equities and bonds led to a net decline of $55.3 million in assets to $1.37 billion. Excluded is the $101.9 million shifted into the segment by the rebranded Franklin Municipal Green Bond ETF that was launched in early May. The fund represents a better value proposition for municipal investors relative to Franklin’s Green Municipal Bond mutual fund that has now been liquidated.

- Green bond funds were not spared during April’s volatility, but their performance held up well. Taxable green bond funds (excluding the Franklin Municipal Green Bond Fund and its four share classes that was slated for liquidation in early May) posted an average drop of 3.34% in April that beat the Bloomberg US Aggregate Bond Index by 45 bps.

- A decline in Q1 sustainable bond issuance has led Moody’s to cut its forecast for sustainable bond issuances during 2022 but demand is expected to remain strong and issuance may surprise on the upside.

Modest outflows during a volatile month led to a net decline of $55.3 million in assets to $1.37 billion and a rebranded municipal green bond ETF was launched

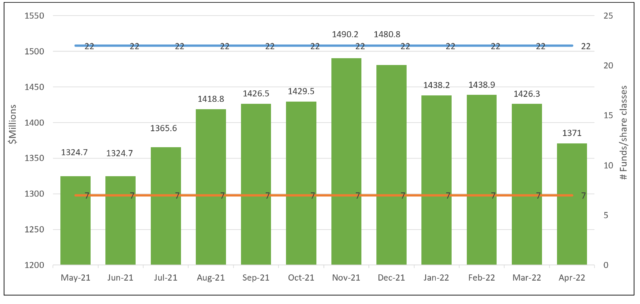

Dedicated green bond funds, consisting of six taxable funds, including four green bond mutual funds and two green bond ETFs, reached $1.37 billion in assets under management at the end of April. Refer to Chart 1. The small segment sustained limited outflows, estimated at $8.1 million on top of an estimated $47.2 million drop due to capital depreciation, for a net decline of $55.3 million or a 3.9% drop. These numbers exclude the Franklin Municipal Green Bond Fund that was to be liquidated on or about May 6th and the launch of the rebranded Franklin Municipal Green Bond ETF (FMLB) as of May 3, 2022 that shifted $101.9 million into the green bonds segment¹.

All funds recorded declines in net assets during the month. While the Calvert Green Bond Fund gave up a net of $30 million, the R6 (CBGRX) share class offered to institutional investors required to make a $5 million minimum investment, is the only share class that experienced a net gain in April. The share class added $29.8 million.

The Franklin Green Municipal Bond ETF invests in municipal securities whose interest is free from federal income taxes and that qualify under Franklin’s definition of green bonds. These include bonds whose proceeds are typically used for one or more of the following purposes: renewable energy, energy efficiency, pollution prevention and control, environmentally sustainable management of living natural resources and land use, terrestrial and aquatic biodiversity conservation, clean transportation, sustainable water and wastewater management, climate change adaptation, eco-efficient and/or circular economy adapted products, production technologies and processes or green buildings that meet regional, national or internationally recognized standards or certifications. External reviewer inputs are not required.

With $101.9 million in net assets and offered at an attractive 3 bps (1 bp higher than iShares USD Green Bond ETF and the VanEck Green Bond ETF), the fund benefits from scale at inception and represents a better value proposition for municipal investors relative to Franklin’s Green Municipal Bond mutual fund that has now been liquidated. At the same time, the fund’s performance track record will have to be established.

Chart 1: Number of green bond mutual funds and ETFs and assets – May 2021 – April 29, 2022

Notes of Explanation: Franklin Municipal Green Blond Fund and tis four share classes with total net assets of $9.7 million included in the data. At the same time, the rebranded Franklin Liberty Federal Tax-Free Bond ETF renamed the Franklin Municipal Green Bond ETF is excluded as of April 29, 2022. Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

¹ Franklin Templeton rebranded the Franklin Liberty Federal Tax-Free Bond ETF.

Green bond funds were not spared during April’s volatility but their performance has held up

Fixed income came under increasing pressure, with 10-year Treasury yields moving up 57 bps since March 31st to end the month of April at 2.89%. Yield have risen 137 bps since the start of the year and expectations for the path of monetary policy have undergone a major shift with the market now pricing in interest rates in the US of over 2% by year-end. The Bloomberg US Aggregate Bond Index dropped 3.79% in April, the worst month since 1980, and is now down 9.5% year-to-date and -8.51% for the trailing 12-months versus the S&P 500 that eked out a gain of 0.21%. The Russian invasion of Ukraine, diminished growth expectations, high inflation and rate hikes ahead introduced substantial economic and market uncertainties that continued into May and are likely to extend beyond this month.

Green bond funds were not spared, but they have held up well. Taxable green bond funds (excluding the Franklin Municipal Bond Fund and its four share classes) posted an average drop of 3.34% in April that beat the Bloomberg US Aggregate Bond Index by 45 bps. Since the start of the year, green bond funds on average gave up -8.98%. This exceeded by 52 bps the total return results recorded by the conventional Bloomberg US Aggregate Bond Index, down 9.5%. Refer to Table 1.

Returns in April recorded by the six green taxable sustainable mutual funds and ETFs ranged from a high of -2.95% registered by both the PIMCO Climate Bond Fund I-2 and Institutional (PCEIC) share classes to a low of -3.73% posted by the Mirova Global Green Bond Fund Fund A (MGGAX).

That said, the average performance of taxable green bond funds trailed behind the Bloomberg US Aggregate Bond Index for intervals of one, three and five years, covering both time frames during which returns were negative (1-year) and positive (3 and 5 years). During its three full years of operation, the TIAA-CREF Green Bond Fund, including it five share classes, generated returns in excess of the Bloomberg US Aggregate Bond Index as well as other broad and narrow indices.

Decline in Q1 sustainable bond issuance led Moody’s to cut its forecast for sustainable bonds during 2022 but demand is expected to remain strong

As reported last month, difficult market conditions for both equities and bonds influenced sustainable bond issuances in the first quarter. According to Reuters, global sustainable bond issuance in the first quarter totaled $231.7 billion, recording a 19% drop over the same period in 2021. Developing geopolitical and market conditions led Moody’s to cut its forecast for sustainability and sustainability linked bonds to roughly $1.0 trillion this year from a prior $1.35 trillion estimate, or a decline of 25%.

That said, demand for sustainable debt instruments is expected to remain strong as investment management firms continue to respond to investor calls for sustainable product offerings, particularly on the institutional side. Further, investment management firms that have committed to achieving net-zero targets are likely to meet such targets, in part, by seeking out low carbon issuers, bonds sourced to firms that have likewise made commitments to decarbonize, green bonds as well as sustainability-linked bonds with ESG performance goals. Such a development could potentially overtake green and sustainable bond issuances and offer a surprise to the upside in the aggregate.

Table 1: Green bond funds: Performance results, expense ratios and AUM-April 29, 2022

Fund Name | Symbol | April 2022 TR (%) | Y-T-D TR (%) | 12-Month TR (%) | 3-Year Average TR (%) | 5-Year Average TR (%) | Expense Ratio (%) | AUM ($millions) |

Calvert Green Bond A* | CGAFX | -3.22 | -8.74 | -8.72 | 0.14 | 1.02 | 0.73 | 79.7 |

Calvert Green Bond I* | CGBIX | -3.19 | -8.65 | -8.48 | 0.39 | 1.31 | 0.48 | 746.4 |

Calvert Green Bond R6* | CBGRX | -3.12 | -8.63 | -8.43 | 0.47 | 0.43 | 41.6 | |

iShares USD Green Bond ETF**^ | BGRN | -3.61 | -10.05 | -9.83 | -0.65 | 0.2 | 245.1 | |

Mirova Global Green Bond A* | MGGAX | -3.73 | -9.5 | -10.25 | -0.34 | 0.99 | 0.94 | 6.4 |

Mirova Global Green Bond N* | MGGNX | -3.72 | -9.41 | -9.95 | -0.06 | 1.31 | 0.64 | 4.9 |

Mirova Global Green Bond Y* | MGGYX | -3.72 | -9.43 | -10 | -0.08 | 1.25 | 0.69 | 29.1 |

PIMCO Climate Bond A* | PCEBX | -2.98 | -8.54 | -8.19 | 0.94 | 0.8 | ||

PIMCO Climate Bond C* | PCECK | -3.04 | -8.77 | -8.89 | 1.69 | 0 | ||

PIMCO Climate Bond I-2* | PCEPX | -2.95 | -8.45 | -7.92 | 0.64 | 0.5 | ||

PIMCO Climate Bond I-3* | PCEWX | -2.96 | -8.46 | -7.96 | 0.69 | 0.1 | ||

PIMCO Climate Bond Institutional* | PCEIX | -2.95 | -8.42 | -7.82 | 0.54 | 10.9 | ||

TIAA-CREF Green Bond Advisor* | TGRKX | -3.5 | -9.06 | -7.96 | 1.03 | 0.55 | 3.1 | |

TIAA-CREF Green Bond Institutional* | TGRNX | -3.5 | -9.05 | -7.95 | 1.05 | 0.45 | 74.3 | |

TIAA-CREF Green Bond Premier* | TGRLX | -3.51 | -9.09 | -8.07 | 0.92 | 0.6 | 1 | |

TIAA-CREF Green Bond Retail* | TGROX | -3.52 | -9.13 | -8.2 | 0.78 | 0.78 | 7.4 | |

TIAA-CREF Green Bond Retirement* | TGRMX | -3.51 | -9.09 | -8.07 | 0.91 | 0.7 | 14.8 | |

GRNB | -3.35 | -9.17 | -9.31 | -0.26 | 0.71 | 0.2 | 95.3 | |

Average/Total | -3.34 | -8.98 | -8.67 | 0.33 | 1.10 | 1361.4 | ||

Bloomberg US Aggregate Bond Index | -3.79 | -9.5 | -8.51 | 0.38 | 1.2 | |||

Bloomberg Global Aggregate Bond Index | -5.48 | -11.3 | -12.63 | -1.09 | 0.33 | |||

Bloomberg Municipal Total Return Index | -2.77 | -8.82 | -7.88 | 0.46 | 1.8 | |||

S&P Green Bond US Dollar Select IX | -3.6 | -9.92 | -9.49 | -0.28 | 1.52 | |||

ICE BofAML Green Bond Index Hedged US Index | -3.29 | -9.27 | -9.13 | 0.42 | 1.34 |

Notes of Explanation: Blank cells=NA. 3 and 5-year returns are average annual total returns. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. ^Effective March 1, 2022, fund shifted to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC