About a year after closing on the acquisition of Pioneer Investments by Amundi Asset Management, the combined Amundi Pioneer Asset Management entity in the US amended the prospectuses of two of its leading funds as of July 1, 2018 to provide for the expansion of factors used in the selection of investments for the $5 billion Pioneer Fund and $271.5 million Pioneer Classic Fund. The prospectus for each of the two funds was amended to account for the consideration of sustainable business practices, including through environmental, social and/or corporate governance (ESG) policies, practices or outcomes. In addition, the funds are empowered to exclude corporate issuers that do not meet or exceed minimum ESG standards and to exclude companies significantly involved in certain business activities, including but not limited to, the production of alcohol, tobacco products and certain controversial military weapons, and the operation of coal mines and gambling casinos and other gaming businesses. More specific details and thresholds in each case, which would add transparency for the benefit of investors, are not provided. Prospectus amendments or changes to a fund’s investment objectives may be made without shareholder approval to the extent that these are not deemed to be fundamental, however, they may require at least 60 days’ notice prior to the implementation of changes to non-fundamental policies. That said, the ESG changes outlined above do invite questions about the opportunity that fund investors more generally should have to express their approval for these types of modifications when the adoption of ESG factors could potentially impact current and future fund practices, portfolio holdings as well as investment performance results. Also, investors might incur additional expenses in the event that securities have to be sold to comply with updated ESG guidelines.

Consideration of various factors for purposes of assessing the true value of a company and its exposure to risks and opportunities, whether these are in the form of qualitative considerations, such as business model and competitive position, and/or various metrics, such as PE ratios, sales-growth, return on capital, and earnings growth, to mention just a few, and/or any relevant and material environmental, social and government factors, should always be part of the investment tool kit available to fund managers and, to the extent one or more of these tools are revised or updated, shareholder approval should not be required.

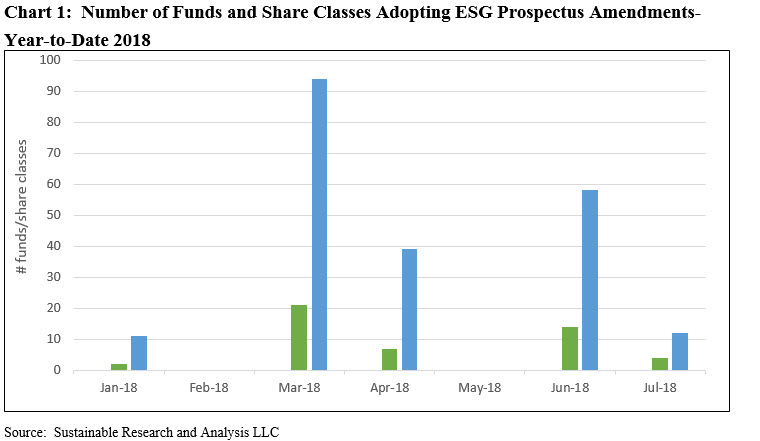

On the other hand, the type of modifications adopted by Amundi Pioneer, involving the exclusion of corporate issuers that do not meet or exceed minimum ESG standards and companies significantly involved in certain business activities, arguably rise to a level that should invite positive shareholder consent. Such changes could impact current and future fund holdings and the future investment performance of the fund. Also, investors might incur additional expenses in the event that securities have to be sold to comply with the funds’ updated investment guidelines at the time of implementation. Since the beginning of the year, nine fund firms adopted ESG mandates of varying types by amending the prospectuses applicable to 48 funds comprised of 214 share classes with assets of about $40 billion. Refer to Chart 1.

Admittedly, shareholders can always vote with their feet. Also, a mitigating factor in the case of Amundi Pioneer is that the firm’s ESG focus is apparently not new. In a press release announcing the change, Ken Taubes, Chief Investment Officer, was quoted as follows: “ESG-related considerations are core elements of Amundi Pioneer’s research process and play a key role in security selection decisions across a broad array of our actively managed investment strategies. Investing in companies with sustainable business models and strong competitive positions has been a core focus of our firm for decades. Our view is that ESG factors are becoming increasingly important in understanding investment risk, and our ability to identify companies that have the potential to outperform over the long term.”

That may indeed be the case, and if so, the company’s statement summons the question of why Amundi Pioneer does not extent this approach to cover the firm’s entire universe of mutual fund offerings as they too would benefit from this additional research. But Amundi Pioneer is going beyond strictly ESG integration. The funds also now permit certain exclusions that could restrict the implementation of the portfolios’ strategies and may also call for the liquidation of certain securities that might impact performance and lead to additional expenses should current holdings have to be sold to conform to the new prospectus language. For example, Pioneer Classic Balanced Fund held shares of BHP Biliton, Ltd (BBL), the Australian-based mining operator, and Honeywell International, Inc. (HON) which is involved in defense work within the aerospace division of the company. At the same time Pioneer Fund held shares of both HON and Raytheon Company (RTN), a major U.S. defense contractor and industrial corporation with core manufacturing concentrations in weapons and military and commercial electronics. While the parameters for exclusion are not spelled out, to the extent that these investments qualify as a mining company or as a firm involved in certain controversial military weapons, these might have to be sold and in the process the funds would, at the very least, have to absorb some incremental transaction fees.