The Bottom Line: Even as the majority of US and international equity managers continue to underperform, new launches of actively managed sustainable ETFs tick up.

Observations

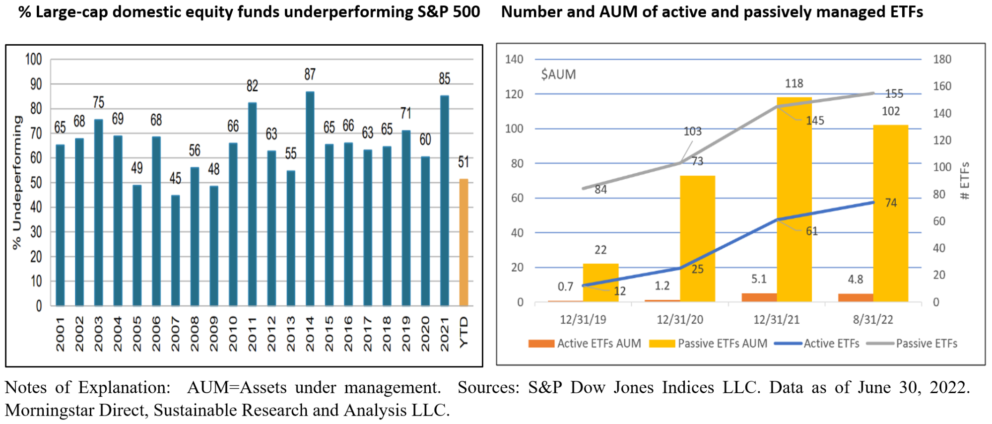

- According to the just released S&P Dow Jones Indices SPIVA report¹ that measures the performance of actively managed funds against their relevant S&P index benchmarks, 49% of actively managed large-cap domestic equity fund managers were able to outperform their corresponding benchmarks during the first six months of 2022. Or, put another way, 51% underperformed. This was a period during which the S&P 500 gave up 19.96% and fixed income, as measured by the Bloomberg US Aggregate Bond Index, was down 13.91%.

- This represents a significant minority of active managers, and it puts actively managed large-cap US equity funds on track for their best (i.e., lowest) underperformance rate since 2009. Underperformance across US market capitalization ranges was even higher, with 54% of mid-cap and 63% of small-cap funds underperformed the S&P MidCap 400 and the S&P SmallCap 600, respectively.

- As for international equities, a majority of actively managed funds underperformed in every category. On the other hand, 93% of Core Plus Bond funds and 59% of actively managed high-yield US funds outperformed the iBoxx $ Liquid Investment Grade Index and iBoxx $ Liquid High Yield Index. This was not the case, however, for other fixed income categories.

- There is no reason to believe that sustainable funds would perform any differently, yet interestingly, the latest interval of underperformance by US equity fund managers coincides with a pickup in the launch of actively managed sustainable ETFs. As of August 31, 2022, there are a total of 74 actively managed ETFs with total net assets in the amount of $4.8 billion. The segment is dominated by equity funds that account for 74% of funds by number and 71% of assets under management.

- During the eight month-interval since the start of the year, actively managed sustainable ETFs expanded by 13 ETFs, or 21.3%, while passively managed sustainable ETFs expanded by 10, or an increase of 6.5%.

¹ S&P Indices Versus Active (SPIVA) measures the performance of actively managed funds against their relevant S&P index benchmarks.