The Forum for Sustainable and Responsible Investment (USSIF) released its 2018 Biennial Foundation’s “Report On US Sustainable, Responsible and Impact Investing Trends.” The Report, based on data collected and analyzed through the beginning of 2018, disclosed that assets linked to sustainable, responsible and impact investing (SRI) strategies have reached $12.0 trillion, up 38% percent from $8.7 trillion in 2016. According to USSIF, this represents one in four dollars out of the $46.6 trillion in total assets under professional management in the United States. The report notes that “asset management firms and institutional investors are addressing a diverse set of environmental, social and governance concerns across a broader span of assets than in 2016. Many of these money managers and institutions, concerned about racial and gender discrimination, gun violence and the federal government’s rollbacks of environmental protections, are using portfolio selection and shareowner engagement to address these important issues.”

Much of this growth, per the report, is driven by asset managers, who now consider environmental, social or corporate governance (ESG) criteria across $11.6 trillion in assets, up 44% from $8.1 trillion in 2016. The top three issues for asset managers and their institutional investor clients are climate change/carbon, tobacco and conflict risk. While we are challenged to understand the absolute numbers, especially when juxtaposed against mutual funds and ETFs that are classified as sustainable investments which stand at only $312.6 billion as of September 30, 2018 and account for a small 1.5% fraction of combined long-term mutual fund and ETF assets, the overall increase reported by USSIF is consistent with the growing attention directed at SRI investing linked to a range of strategies and practices encapsulated in SRI, from values/faith-based and social investment strategies, exclusionary practices, ESG integration, impact/thematic investing, to shareholder engagement and proxy voting. Regardless of the top line numbers, however, we believe that perhaps as much as 50% of the assets sourced to SRI strategies are likely linked to exclusionary practices, such as tobacco, weapons and alcohol, to mention just some.

Among money managers, social factors were incorporated into investment decisions at a level slightly more than environmental and governance criteria. Social criteria incorporation by money managers increased 39% from 2016 to $10.8 trillion. That said, tobacco-related restrictions saw the greatest growth of any ESG criteria, increasing 432% from 2016 to $2.9 trillion.

USSIF Report: $8.6 trillion of assets under institutional management

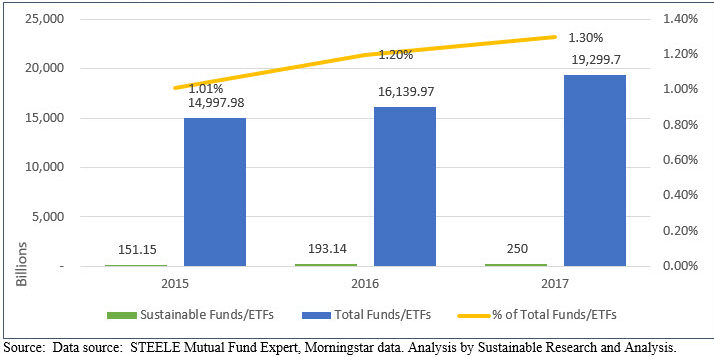

The Report’s Executive Summary further discloses that $8.6 trillion of the assets, or 74%, were managed on behalf of institutional investors and $3.0 trillion were managed on behalf of individual investors. A total of $2.6 trillion, or 22%, were managed through registered investment companies such as mutual funds, exchange-traded funds, variable annuities and closed-end funds. Here is where our view starts to diverge from USSIF. According to our research, based on Morningstar data, at the end of December 2017, a date intended to approximate USSIF’s early 2018 date for the report terminal date, assets sourced to sustainable investing strategies of mutual funds, ETFs and ETNs stood at $250.4 billion, including $243.1 billion in mutual funds and $7.3 billion in ETFs and ETNs. While this number excludes variable annuities and closed-end funds, we doubt that the difference of $2.3 trillion is explained by these investment products alone. While sustainable assets under management increased some 65.6%, over the two-year interval to December 2017, gaining 28% in 2016 and 30% in 2017, a significant component of that increase is linked to the repurposing of existing funds as well as fund reclassifications. As a percentage of industry assets under management (AUM), sustainable mutual funds and ETFs continue to represent just a small 1.3% fraction of the universe, up from 1.01% at the end of 2015. Refer to Chart 1.

Sustainable and Total Mutual Funds and ETFs: 2015-2017

USSIF’s report will receive much coverage in the weeks and months ahead and the base-line number of $12 trillion in SRI assets will be widely quoted until the next USSIF survey is published. While we believe SRI in its various forms and strategies has and will continue to gain traction, especially ESG integration, the reported aggregate AUM and top-line growth in AUM doesn’t as yet align with what is being observed through the lens of mutual fund and ETF assets under management. At the same time, the role of retail investors, in particular, remains muted and likely calls for greater educational efforts and the expansion of product offerings.