The Bottom Line: Only 13 sustainable funds (42 funds/share classes) posted positive rates of return for calendar 2022, led by energy transition thematic equity funds.

0:00

/

0:00

Listen to this article now

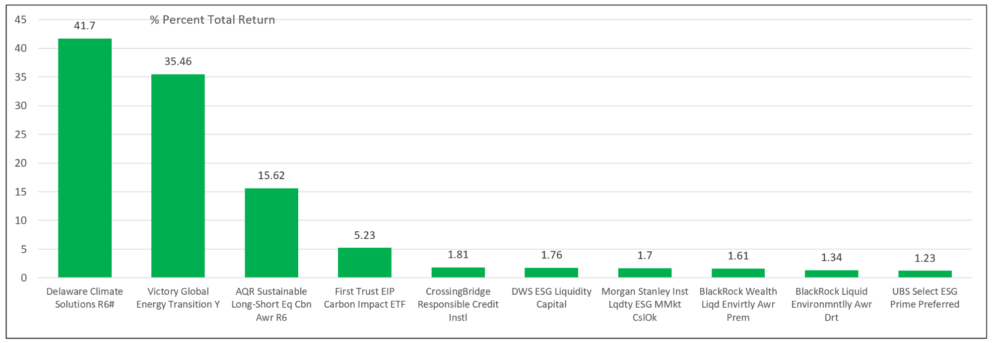

Top 10 performing sustainable funds (mutual funds and ETFs) in 2022

Sources: Notes of Explanation: # Fund repositioned as of July 29, 2022. In the case of mutual funds with multiple share classes, only the best performing share class and its total return for 2022 is displayed in the graph. Performance data=Morningstar Direct; sustainable investing strategies source=Sustainable Research and Analysis LLC.

Sources: Notes of Explanation: # Fund repositioned as of July 29, 2022. In the case of mutual funds with multiple share classes, only the best performing share class and its total return for 2022 is displayed in the graph. Performance data=Morningstar Direct; sustainable investing strategies source=Sustainable Research and Analysis LLC.

Observations:

- Of 1,181 sustainable funds/share classes in operation throughout 2022, only 13 sustainable funds, for a total of 42 funds/share classes, posted positive rates of return. The list is dominated by mutual funds, but also covers two ETFs, and, by investment category, includes five sustainable money market funds, three thematic energy transition equity funds, three taxable bond funds, one equity fund as well as one nontraditional equity fund. All but one of the funds are actively managed and two of the 13 funds were rebranded during the year.

- A reflection of the difficult and anomalous market conditions in 2022 when both equities and fixed income securities were pummeled and energy was the only positive sector for the year, the average total return registered by the universe of 1,181 sustainable funds was -16.84%. That said, the 13 funds along with all 42 funds/share classes with positive returns recorded an average gain of 11.3%, with returns ranging from 0.1% to 41.7%. Excluding the top performing fund because it was repositioned mid-year brings the calendar year 2022 average total return for the positive performing funds down to 6.3%.

- The range of positive performing fund types by investment category is captured by lining up the top 10 performing funds. Also illustrated by focusing on these top performing funds is the range and variety of sustainable investing approaches employed by sustainable mutual funds and ETFs. This is on top of any other qualitative and quantitative investment considerations.

- The five top performing money market funds benefited from increasingly higher interest rates in 2022 and generated returns extending from 1.23% to 1.76%. These funds approach sustainable investing in varying ways. DWS ESG Liquidity Fund employs an ESG integration best-in-class approach. Morgan Stanley Institutional Liquidity ESG Money Market Fund and UBS Select ESG Prime Fund have both adopted a credit risk oriented ESG integration approach along with certain exclusions; and finally, the BlackRock Wealth Liquidity Environmental Awareness Fund and the BlackRock Liquid Environmentally Aware Fund rely on screening based on environmental criteria along with certain exclusions.

- The best performing fund in 2022 along with two other funds that fall into the top 10 category are thematic energy transition equity funds. Delaware Climate Solutions Fund R6 (EINRX) posted a return of 41.7%, however, the fund was repositioned as of July 29, 2022 from the Delaware Ivy Energy Fund. The fund now focuses on identifying and investing in companies that seek to reduce, displace, and/or sequester their greenhouse gas emissions (GHG) or those that facilitate the reduction of GHG for others. Its leading 12-month performance is heavily weighted by the fund’s results achieved prior to its rebranding at which time it invested in companies within the energy sector, including, for example, companies engaged in the exploration, discovery, production, distribution or infrastructure of energy and/or alternative energy sources. Two other energy transition thematic equity funds registered positive returns: The first is the concentrated $409.9 million actively managed Victory Global Energy Transition Fund Y class (RSNYX), up 35.46%, that invests in companies located anywhere in the world engaging in natural resources industries that supply critical input materials for or own infrastructure that will be key to enabling the broader objective of decarbonization. The second is the $34.6 million First Trust EIP Carbon Impact ETF (ECLN), up 5.23%, investing in companies that have or seek to have a positive carbon impact. The fund benefited from overweighting exposures to natural gas pipeline companies and liquid natural gas terminal companies.

- The third best performing fund in 2022 is the AQR Sustainable Long-Short Equity Carbon Aware Fund R6 (QNZRX), up 15.62%. The fund employs a long-short investment strategy that considers the positive and negative ESG characteristics from a financially relevant risk perspective. Covering both US and foreign securities, the fund also seeks to manage the fund’s exposure to greenhouse gas emissions by targeting a “net-zero” carbon positioning.

- The $23.1 million CrossingBridge Responsible Credit Fund (BRDX), a multisector short-duration bond fund that was launched in 2021, was up 1.81%. The fund employs responsible investing criteria based on ESG standards along with exclusions. Eligible issuer’s securities or other instruments must meet the fund’s minimum ESG threshold level.

- For sustainable investors, the variations in and wide-ranging approaches to sustainable investing illustrated by the top 10 performing funds reinforces the need on the part of investors to conduct fund due diligence via their financial advisors or directly on their own by carefully reviewing all available fund information before investing to ensure alignment with their sustainable investing preferences.